Want to succeed in day trading? Start by mastering chart patterns, which help predict market movements. This guide explains key patterns like flags, triangles, and head and shoulders, along with practical tips on risk management, timing trades, and using the right tools.

Key Takeaways:

- Day Trading Basics: Buy and sell within the same day to capture small price moves.

- Chart Patterns: Learn patterns like bullish/bearish flags, triangles, and head and shoulders for trend analysis.

- Risk Management: Only risk 1% of your capital per trade and set clear stop-loss levels.

- Tools & Hardware: Use platforms like TradingView or TrendSpider paired with high-performance computers for fast execution.

- Best Practices: Plan trades carefully, avoid overtrading, and practice with demo accounts.

Quick Comparison of Trading Tools:

| Platform | Monthly Cost | Candlestick Patterns | Chart Patterns | Best Feature |

|---|---|---|---|---|

| TrendSpider | $54 | 150 | 18 | Multi-timeframe automation |

| TradingView | $0–$59 | 39 | 10 | Free pattern recognition |

| Finviz Elite | $25 | 11 | 12 | Budget-friendly scanning |

| MetaStock | $100+ | Varies | Varies | Win/loss probabilities |

Pro Tip: Start with simple patterns like flags and triangles, and practice in a demo account before trading real money. Pair your strategy with reliable tools and hardware for the best results. Let’s dive deeper into the details!

The Ultimate Guide To Chart Patterns (For Beginners)

Key Day Trading Chart Patterns

Chart patterns can help traders understand market behavior and make better decisions about when to buy or sell. Below are some essential patterns every beginner should know. Each one provides specific signals and trading strategies.

Flag Patterns: Bullish and Bearish

Flag patterns are continuation patterns that show a temporary pause in a strong trend before the price continues moving in the same direction. These patterns consist of a sharp price movement (the flagpole) followed by a consolidation phase, which usually lasts five to fifteen bars[4].

In an uptrend, a bullish flag forms when the price consolidates downward after a sharp rise. In a downtrend, a bearish flag appears as the price consolidates upward after a sharp drop. A key signal is a drop in trading volume during the consolidation phase, followed by a breakout that confirms the pattern. Research and trading experience suggest flag patterns have about 70% accuracy[3][4]. To trade them, look for a strong trend, identify the consolidation phase, and enter on a breakout beyond the flag’s boundary. Use stop-loss orders to manage risk.

Next, let’s discuss triangle patterns, which also signal opportunities during consolidations.

Triangle Patterns: 3 Main Types

Triangle patterns form when the price compresses between converging trendlines during a consolidation phase.

- Ascending Triangle: This pattern has a flat resistance line and a rising support line, showing that buyers are pushing prices higher. It usually signals an upward breakout.

- Descending Triangle: Here, the resistance line slopes downward while the support line stays flat. Sellers are driving prices lower, often leading to a downward breakout.

- Symmetrical Triangle: This pattern forms when both support and resistance lines converge, indicating indecision in the market. Breakouts can occur in either direction.

To trade these patterns, wait for a confirmed breakout. For ascending triangles, place buy orders above the resistance. For descending triangles, place sell orders below the support. With symmetrical triangles, prepare for movement in either direction, depending on the breakout.

These patterns work well alongside reversal indicators like the head and shoulders formation.

Head and Shoulders Patterns

The head and shoulders pattern is one of the most reliable indicators of trend reversals[6]. It consists of three peaks: the highest peak in the middle (the head) and two lower peaks on either side (the shoulders). The neckline connects the troughs between the peaks. The pattern is confirmed when the price breaks below the neckline with increased volume, signaling a potential reversal of an uptrend.

"The head and shoulders chart pattern is a powerful tool in technical analysis, widely recognized for its ability to signal potential trend reversals in financial markets."

– Shaun Murison, Senior Market Analyst [5]

The inverse head and shoulders pattern works the same way but appears during downtrends. It features three troughs, with the middle one being the deepest, and signals a potential bullish reversal. For a standard head and shoulders, enter short after the price breaks below the neckline. For an inverse pattern, go long after a breakout above the neckline. Use the distance between the head and the neckline to set profit targets and stop-loss levels.

How to Use Patterns in Trading

Using chart patterns effectively can make all the difference between a successful trade and a missed opportunity. To make the most of these patterns, you need to focus on timing, manage your risks wisely, and tailor your approach to match the dynamics of the US market.

Planning Entry and Exit Points

The foundation of profitable pattern trading lies in timing your entries and exits with precision. When entering a trade, rely on confirmed breakouts rather than trying to predict them. For instance, if you’re analyzing an ascending triangle on a 30-minute BTCUSD chart, wait for a confirmed breakout before entering. Your price target should match the height of the triangle.

Exits demand just as much attention. Calculate your take-profit level by measuring the height of the pattern and projecting it from the breakout point. This method helps you avoid making emotional decisions during the trade.

To protect your capital, place your stop-loss just beyond the pattern’s boundary. For example, in flag patterns, the target is typically equal to the height of the flagpole, giving you a clear risk-reward ratio before you commit to the trade.

"Examining price charts is a great way to learn about stock price behavior. Fundamental analysts use them to pinpoint inflection points tied to past events, while technical traders rely on price charts to identify entry and exit points." – Charles Schwab [7]

Volume confirmation is another critical factor. A breakout accompanied by rising trading volume often signals stronger conviction behind the price move. On the other hand, breakouts without significant volume can lead to false signals, so always consider this when planning your trades.

Once you’ve established your entry and exit points, the next step is to reinforce your strategy with solid risk management.

Risk Management and Position Sizing

After setting clear entry and exit points, the next priority is aligning your position size with your risk tolerance. A common rule of thumb is to risk no more than 1% of your total capital on any single trade. For example, if you have a $10,000 trading account, your maximum risk per trade should be $100.

Position sizing becomes straightforward once you know your risk tolerance. Let’s say you’re trading a head and shoulders pattern, with a stop-loss set 50 points away from your entry, and you’re willing to risk $100. Divide your $100 risk by the 50-point stop-loss distance to calculate your position size.

It’s also important to align your stop-loss placement with the structure of the pattern rather than relying on arbitrary percentages. For a double bottom, place your stop-loss just below the lowest point of the pattern. For a double top, position it just above the highest peak. This ensures your stop-loss is set at a logical level, protecting your trade while allowing the pattern to play out.

To stay profitable, maintain favorable risk-reward ratios. For instance, even with a 50% win rate, you can succeed if your average profit is double your average loss. On the flip side, even a 75% win rate won’t help if your losses far outweigh your gains.

Set daily loss limits to safeguard your capital. Establish maximum loss thresholds per trade, day, and week to avoid significant setbacks. If you hit your daily limit, step away from the market to prevent emotional decision-making.

Trading During US Market Hours

The timing of your trades can have a big impact, especially during US market hours. The pre-market session (4:00 AM – 9:30 AM ET) typically has lower trading volume, which can make chart patterns less reliable. Most trading activity occurs during regular market hours (9:30 AM – 4:00 PM ET), when institutional investors are most active.

The first hour after the market opens (9:30 AM – 10:30 AM ET) is often the most volatile. This period can lead to dramatic breakouts, but it’s also prone to false signals. Many traders prefer to wait until this initial volatility subsides before acting on patterns.

During the midday hours (12:00 PM – 2:00 PM ET), trading volume often declines, leading to sideways price action. Patterns that form during this period may lack the volume needed for strong breakouts.

If you’re trading international assets during US hours, keep an eye on currency influences and economic news. Announcements like US Non-Farm Payrolls or Federal Reserve updates can cause sudden market shifts, invalidating technical patterns. It’s often best to avoid trading during these high-volatility events.

Strategy Comparison

Once you’ve mastered trade planning and risk management, compare different strategies to see what fits your style. Each pattern-based strategy offers unique risk-reward dynamics. For example, head and shoulders patterns are highly regarded for their accuracy, with studies showing they hit their targets nearly 85% of the time [9]. Whether you prefer a discretionary or systematic approach will depend on your trading habits and the time you can dedicate.

Before committing real money, practice in a demo account. This allows you to refine your pattern recognition skills and test your timing without the pressure of financial loss. It’s the perfect way to build confidence in your strategy.

sbb-itb-24dd98f

Tools and Hardware for Pattern Analysis

Turning pattern strategies into consistent profits demands a setup capable of processing real-time data efficiently. To successfully translate chart patterns into actionable trades, you need both reliable software and high-performance hardware.

Trading Software for Chart Analysis

The backbone of pattern recognition lies in selecting the right software. Here are some standout options:

- TrendSpider: At $54 per month, this platform automates the recognition of 150 candlestick patterns and 18 chart patterns across multiple timeframes. Its AI-driven tools help test patterns for reliability and profitability, making it a great choice for beginners.

- TradingView: Starting at $12.95 per month, TradingView offers automated analysis for 39 candlestick patterns and visually highlights them on charts. For example, bearish engulfing patterns are marked in red with downward arrows, while Doji patterns appear in gray with upward arrows. It’s a cost-effective option for traders seeking advanced scanning features.

- Finviz Elite: Priced at $25 per month, this platform is ideal for budget-conscious traders. A 2025 test revealed that its backtesting service helped create a system based on the Money Flow Index, which outperformed the S&P 500 over 24 years, delivering a 1,588% profit with a 15.24% annual return compared to the S&P 500’s 10.86% [11].

- MetaStock: At $100 per month (plus data fees), MetaStock offers a probability-based approach to candlestick trading. It provides insights into the win/loss probabilities of patterns, helping traders make informed decisions.

| Platform | Monthly Cost | Candlestick Patterns | Chart Patterns | Best Feature |

|---|---|---|---|---|

| TrendSpider | $54 | 150 | 18 | Multi-timeframe automation |

| TradingView | $0–$59 | 39 | 10 | Free pattern recognition |

| Finviz Elite | $25 | 11 | 12 | Budget-friendly scanning |

| MetaStock | $100+ | Varies | Varies | Win/loss probabilities |

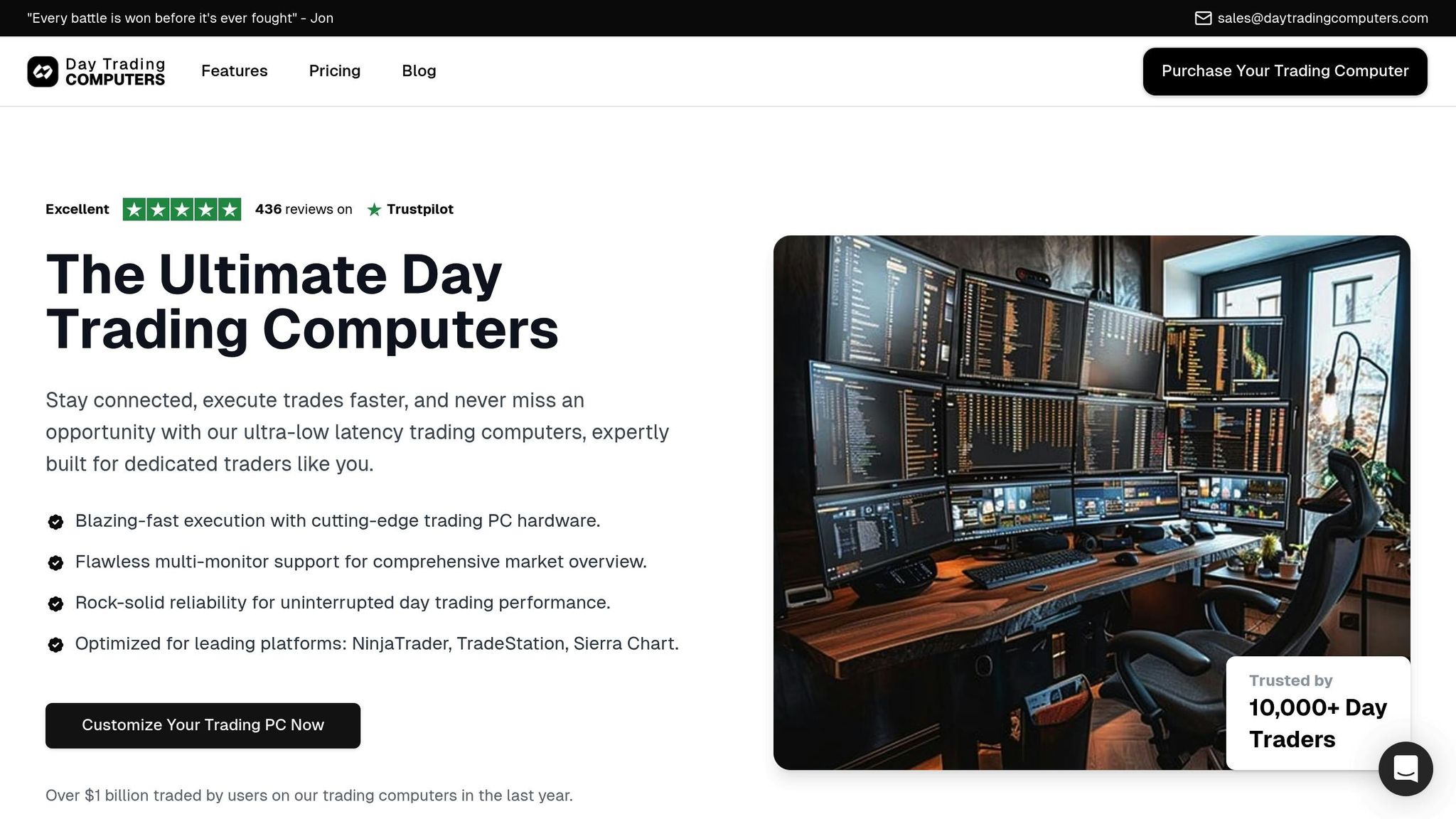

Pairing these tools with robust hardware ensures seamless analysis and execution.

Why High‑Performance Hardware Matters

For effective pattern analysis, your hardware should meet certain performance benchmarks:

- Processor: An Intel i7 or AMD Ryzen 7 is sufficient for basic tasks, but advanced scanning benefits from an Intel i9 or AMD Ryzen 9 [10].

- Memory (RAM): 32 GB of RAM ensures smooth multitasking across trading platforms [10].

- Storage: A 512 GB SSD speeds up boot times and improves software responsiveness while offering enough space for trading applications [10].

- Graphics Card: A dedicated GPU like the NVIDIA GTX 1660 supports multi-monitor setups, while higher-end options like the NVIDIA RTX 3070/3080 or AMD Radeon RX 6800 deliver optimal performance [10].

- Internet Connection: A wired Ethernet connection ensures stable, fast connectivity for real-time data analysis and trade execution [10].

- Monitors: A single 4K monitor provides the same workspace as two 1080p screens. Multiple monitors allow you to dedicate specific screens to charts, watchlists, and news feeds.

DayTradingComputers Product Options

Optimized hardware is essential for precise pattern analysis, and DayTradingComputers offers systems tailored to meet these demands. Their pre-configured systems come with Windows 11 and are optimized for major trading platforms.

- Lite Model ($3,569): Designed for beginners, it features an NVIDIA GeForce RTX 3070 Ti, 32 GB DDR5 RAM, an AMD Ryzen 5600X processor, and 1 TB NVMe SSD. This setup handles basic pattern recognition software and multiple charts with ease.

- Pro Model ($4,569): A step up in performance, this model includes an NVIDIA GeForce RTX 4070 Ti, 64 GB DDR5 RAM, an AMD Ryzen 7900X processor, and 2 TB NVMe SSD. It’s perfect for advanced pattern recognition tools running across multiple timeframes.

- Ultra Model ($5,569): Built for professional traders, this powerhouse boasts an NVIDIA GeForce RTX 4090, 128 GB DDR5 RAM, an AMD Ryzen 9800X3D processor, and 4 TB NVMe SSD. It can handle the most demanding setups, including AI-powered tools and multiple trading platforms running simultaneously.

| Model | Price | Processor | RAM | Graphics Card | Storage | Best For |

|---|---|---|---|---|---|---|

| Lite | $3,569 | AMD Ryzen 5600X | 32 GB DDR5 | RTX 3070 Ti | 1 TB NVMe | Basic pattern trading |

| Pro | $4,569 | AMD Ryzen 7900X | 64 GB DDR5 | RTX 4070 Ti | 2 TB NVMe | Advanced analysis |

| Ultra | $5,569 | AMD Ryzen 9800X3D | 128 GB DDR5 | RTX 4090 | 4 TB NVMe | Professional trading |

Each model supports up to two monitors out of the box, with options to expand for additional displays. They are specifically designed to meet the ultra-low latency requirements of day trading, ensuring your trades execute quickly and accurately. Plus, they come with comprehensive technical support and upgrade options to adapt to your evolving needs.

Best Practices and Common Mistakes

Succeeding in pattern-based day trading boils down to building good habits and steering clear of costly errors that can trip up beginners. Often, the difference between traders who make money and those who lose it lies in their discipline, preparation, and ability to avoid common pitfalls when applying chart pattern strategies.

Trading Best Practices for Beginners

- Create a detailed trading plan: Your plan should outline your trading thesis, risk/reward ratio, entry and exit points, and stop-loss levels. As the saying goes:

"When you fail to plan, you plan to fail." – Humbled Trader [12]

- Start with paper trading: Use simulated money to practice recognizing patterns and testing strategies without risking real capital. Gradually increase your position sizes as you gain confidence [12].

- Keep a trading journal: Document every trade, including the pattern, entry/exit points, and results. Reviewing your journal helps identify mistakes and improve your strategy over time [14].

- Prioritize quality over quantity: Instead of taking numerous trades, focus on a few well-researched opportunities. Tracking just one or two stocks per session can help you avoid information overload [16][15].

- Wait for patterns to fully form: Jumping into trades too early can drastically reduce your chances of success. Patience is key [8].

- Use technical indicators for confirmation: Tools like RSI, Stochastic, or MACD can validate pattern signals, but only if you fully understand how they work [8].

Now that you know the best practices, let’s explore the common mistakes that can undermine your efforts.

Mistakes to Avoid

- Don’t overtrade: Stick to your stop-loss levels, take breaks during slower periods (like 11:30 AM to 2:30 PM EST), and step away if emotions start to cloud your judgment [12].

- Avoid blindly following chat room alerts: Always do your own research and create independent trading plans. Relying solely on others’ advice can lead to poor decisions [12][14].

- Set strict risk limits: Thoughtful position sizing plays a massive role in portfolio performance – accounting for 91% of results, according to studies [14][19].

- Understand leverage before using it: Many beginners underestimate how leverage can amplify losses. Make sure you fully grasp its risks before diving in [13][14].

- Cut losses quickly: Small setbacks can snowball into bigger problems if you don’t stick to your stop-loss orders [13].

- Never add to losing positions: Averaging down rarely works in day trading. This practice often turns manageable losses into catastrophic ones [14].

- Avoid emotional trading: Fear and greed can lead to impulsive decisions. Base your trades on analysis, not emotions [13][16].

- Keep learning: Use educational resources and demo accounts to continuously sharpen your skills and gain experience [16].

With these do’s and don’ts in mind, let’s look at how you can tailor your strategy to the U.S. market.

US Market Trading Tips

To trade effectively in the U.S. market, it’s crucial to adapt your approach to its specific conditions.

- Focus on peak volatility periods: The best times to trade are the first hour after the market opens (9:30 AM to 10:30 AM EST) and the last hour before it closes (3:00 PM to 4:00 PM EST). Avoid trading during the first 15–20 minutes of the session, as the market is often unpredictable then [18][15].

- Stay informed on market-moving events: Keep an eye on economic announcements, earnings reports, and Federal Reserve updates. These events can create the volume and volatility needed for patterns to form [1][8].

- Trade liquid securities: Stick to stocks on major U.S. exchanges with high trading volume. Avoid penny stocks, as they often lack the liquidity needed for reliable patterns and quick exits [15].

- Use limit orders: During volatile periods, limit orders give you better control over the price you pay or receive compared to market orders [15].

- Stick to favorable risk-reward ratios: Aim for consistent gains over multiple trades instead of expecting every single trade to be a winner [15].

- Start with daily timeframe patterns: Daily charts tend to provide more reliable signals. Once you’re comfortable, you can explore shorter timeframes for more frequent trading opportunities [17].

Conclusion

Day trading patterns offer clear signals to help you time your entry and exit points during fast-moving market conditions. Patterns like head and shoulders, triangles, flags, and candle-over-candle formations serve as a strong starting point for spotting opportunities in the market. Pairing these patterns with technical tools such as RSI, Stochastic, or MACD can further validate signals and minimize the chances of falling for false breakouts [8]. These techniques lay the groundwork for combining strategic execution with modern trading tools.

To thrive in pattern-based day trading, you need discipline, effective risk management, and dependable technology. Warren Buffett famously said, "Risk comes from not knowing what you’re doing" [20]. This underscores the importance of adhering to principles like the 1-2% risk rule per trade and maintaining consistent position sizing to protect your capital over the long haul.

Patience is equally essential – allow patterns to fully form before making your move [2]. Jumping in too early on incomplete setups can quickly turn a solid strategy into a losing one. Regularly practicing pattern recognition through historical data and demo accounts can sharpen your skills and build confidence [8].

Having reliable, high-performance hardware is another critical factor. Fast and efficient equipment ensures you can execute trades without delay and analyze multiple charts simultaneously during pivotal market moments [8]. Staying informed about market events that influence pattern formations, keeping a detailed trading journal, and managing emotions like fear and greed are all key to consistent success [8].

As discussed throughout this guide, becoming a successful pattern trader requires ongoing learning and emotional control. By blending your understanding of chart patterns with disciplined execution and the right trading tools, you’ll be better prepared to navigate the markets confidently and work toward a sustainable trading career.

FAQs

How can I use chart patterns to enhance my day trading results?

To get the most out of chart patterns in day trading, focus on recognizing key formations like head and shoulders, triangles, and flags. These patterns can offer clues about potential price shifts and highlight trading opportunities. Be sure to consider factors such as volume, trend direction, and support and resistance levels to validate the patterns you identify.

For intraday trading, stick to shorter chart timeframes, like 5-minute or 15-minute intervals, which allow you to respond quickly to market fluctuations. By consistently applying these strategies, you can sharpen your ability to spot promising setups and make more informed trading choices.

What should I look for in trading software and hardware for analyzing patterns?

For your hardware, aim for a powerful processor like the Intel Core i7 or AMD Ryzen 7, paired with at least 16GB of RAM. Add to that a large, high-resolution monitor – something in the 27–32 inch range – so you can clearly analyze charts and data. These specs will keep things running smoothly and handle data-heavy tasks without a hitch.

On the software side, focus on tools that deliver consistent performance, advanced charting features, and a simple, user-friendly interface. Key features to look for include compatibility with analytical tools, strong risk management functions, and robust security. Together, the right hardware and software create a setup that makes pattern analysis efficient and hassle-free.

How can I manage risk and set effective stop-loss levels when trading using chart patterns?

Managing risk and deciding on stop-loss levels are essential when trading with chart patterns. To safeguard your trades, it’s wise to position your stop-loss just beyond the key support or resistance levels that form the pattern. For instance, in a bullish pattern, placing the stop-loss slightly below the support line can provide a safety net. In contrast, for a bearish pattern, setting it just above the resistance line is a common approach.

It’s also important to pinpoint the moment when the pattern is no longer valid – like when the price breaks through the support or resistance levels. This approach not only limits potential losses but also ensures you exit trades that stray from your planned strategy. Using these methods together allows for better risk management and a more confident trading experience.