Indicators TradeCopier offers futures traders a one-time payment solution ($175–$295) for trade duplication across multiple accounts, eliminating recurring fees common with competitors. It provides fast, on-platform execution with features like Rithmic one-click resync, risk management tools (daily profit/loss limits, auto-flattening), and compatibility with platforms like NinjaTrader and TradingView. Compared to subscription-based tools like Tradesyncer ($49/month) or Replikanto ($149/year), it stands out for its cost-efficiency and performance. For professional traders managing multiple accounts, especially with prop firms, the $295 Full Suite adds advanced features like a dedicated dashboard for tracking progress and risk. Pairing the tool with a Chicago-based VPS providers further enhances execution speed for high-frequency contracts like NQ or ES.

1. Indicators TradeCopier

Affordability

The Indicators TradeCopier operates on a one-time lifetime payment model. Pricing starts at $175 for the standalone copier or $295 for the complete Accounts Dashboard Suite. With this purchase, you get lifetime updates and live support without any ongoing fees. In comparison, cloud-based trade copiers typically cost around $49 per month (or $588 annually). This means the one-time investment of $175–$295 pays for itself in just four to six months.

Performance and Latency

This tool offers two operation modes: Executions Mode, which instantly replicates fills for precise market orders, and Orders Mode, which mirrors all order activity, allowing for more adaptable follower strategies. A standout feature is the one-click resync function, which is particularly helpful for resolving common Rithmic position synchronization issues quickly.

Risk Management Features

The Accounts Dashboard Suite comes with robust risk management tools. You can set daily profit targets and loss limits with auto-flattening functionality, track auto-liquidation metrics in real time, and use the Exit Shield to secure stop-loss and profit-target orders. It also automatically converts rejected orders to reduce exposure, adding an extra layer of protection.

"My favorite features are that you can setup your daily Goals (Gains or Losses) also you can visually see your progress from being funded all at one place." – Sony S.

Platform Support

The TradeCopier is compatible with several platforms, including NinjaTrader Desktop, TradingView, Tradovate, and Rithmic. It supports various order types like Market, Limit, Stop Market, and Stop Limit. Additionally, it offers features like proportional scaling (e.g., 10%, 25%, 50%) and a Fade option for copying opposite positions. This comprehensive functionality makes it a strong contender for comparison with other leading futures trade copiers.

Best Trade Copier – New Prop Firm Features In NinjaTrader

2. Other Leading Futures Trade Copiers

The futures trade copier market is filled with alternatives, each offering different pricing models and features. Unlike the one-time fee structure of Indicators TradeCopier, many of these options rely on recurring subscriptions or higher upfront costs. Here’s a closer look at how these alternatives compare and why Indicators TradeCopier’s approach stands out.

Affordability

When it comes to pricing, Replikanto charges $199 for a lifetime license or $149 annually, both of which are higher than Indicators TradeCopier’s $175 one-time fee. On the other hand, Tradesyncer follows a subscription model, with monthly plans starting at $49 (or $39 per month if billed annually). Over time, these recurring fees can add up significantly, making Indicators TradeCopier’s single payment structure more appealing for long-term traders.

With pricing out of the way, let’s dive into how these costs reflect in terms of performance and execution.

Performance and Latency

Execution speed is critical in futures trading, where even a slight delay can lead to missed opportunities or increased slippage. As Fred Harrington, Founder of Vetted Prop Firms, explains, “even a 1–2 second delay can cause missed fills or slippage on volatile futures contracts”.

- Tradesyncer operates on a cloud-based platform, boasting 99.9% uptime and execution speeds under 100 milliseconds. While its cloud setup simplifies usage, it may introduce slight delays compared to desktop-based solutions. Despite this, Tradesyncer is trusted by over 17,500 traders globally and holds a 4.5-star rating on Google.

- Replikanto, which requires a desktop connection or VPS, has faced user complaints about order execution issues. However, desktop-based copiers like Replikanto and Indicators TradeCopier can achieve better performance when hosted on one of the best VPS for futures trading located near major exchange hubs, helping to reduce latency.

Risk Management Features

Effective risk management is essential in futures trading, especially for traders managing multiple accounts or working with funded prop firms that impose strict drawdown limits.

- Tradesyncer includes a suite of advanced risk management tools, such as position limits, maximum loss caps, automatic stop-loss settings, manual account lockouts, and time-based trading restrictions. These features are invaluable for protecting accounts and maintaining disciplined trading strategies.

- In contrast, Replikanto and many other cloud-based copiers offer only basic risk management options. They lack critical features like daily profit goals or loss limits, which are especially important for traders adhering to prop firm rules.

Platform Support

Compatibility with trading platforms is another key factor when selecting a trade copier.

- Tradesyncer supports a wide range of platforms, including NinjaTrader with Tradovate, TradingView, Rithmic, dxFeed, and ProjectX. This flexibility is ideal for traders who use multiple brokers or want the freedom to switch platforms without needing a new copier.

- Replikanto also supports NinjaTrader, TradingView, Tradovate, and Rithmic but doesn’t offer the extensive platform coverage found with Tradesyncer.

Pros and Cons

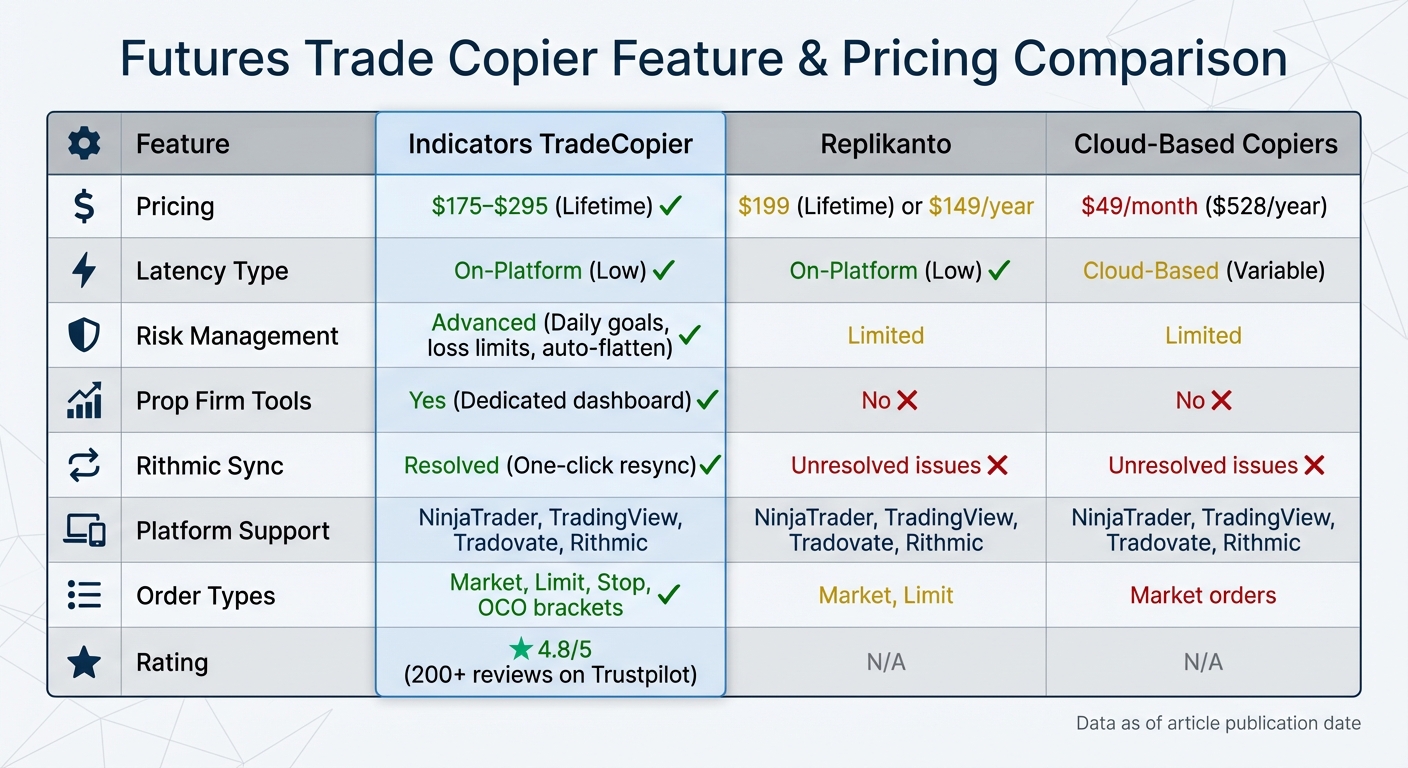

Futures Trade Copier Comparison: Indicators TradeCopier vs Competitors Pricing and Features

Indicators TradeCopier has its strengths and weaknesses, making it a tool worth examining closely. One of its standout features is the one-time pricing of $175–$295, which sets it apart from subscription-based models. The platform also boasts on-platform execution, minimizing latency issues, and a one-click Rithmic position resync to tackle a common industry challenge.

However, there are trade-offs. The advanced risk management tools – such as daily profit goals, loss limits, and prop firm account management – are only available in the Full Suite version, which costs $295. These features are not included in the base $175 version. Additionally, as Affordable Indicators points out, even a slight delay in order duplication – measured in milliseconds – can lead to unfavorable trades. In the high-stakes world of trading, such delays can be costly.

Here’s a quick comparison table summarizing the key features:

| Feature | Indicators TradeCopier | Replikanto | Cloud-Based Copiers |

|---|---|---|---|

| Pricing | $175–$295 (Lifetime) | $199 (Lifetime) or $149/year | $49/month ($528/year) |

| Latency Type | On-Platform (Low) | On-Platform (Low) | Cloud-Based (Variable) |

| Risk Management | Advanced (Daily goals, loss limits, auto-flatten) | Limited | Limited |

| Prop Firm Tools | Yes (Dedicated dashboard) | No | No |

| Rithmic Sync | Resolved (One-click resync) | Unresolved issues | Unresolved issues |

| Platform Support | NinjaTrader, TradingView, Tradovate, Rithmic | NinjaTrader, TradingView, Tradovate, Rithmic | NinjaTrader, TradingView, Tradovate, Rithmic |

| Order Types | Market, Limit, Stop, OCO brackets | Market, Limit | Market orders |

| Rating | 4.8/5 (200+ reviews on Trustpilot) | N/A | N/A |

The platform’s 4.8/5 Trustpilot rating from over 200 reviews highlights user satisfaction, particularly for its TradingView-to-NinjaTrader connection. Users also appreciate the fade capability, which allows follower accounts to take opposite positions – a feature typically missing in cloud-based solutions.

For traders juggling multiple prop firm accounts or requiring precise risk management, the Full Suite offers a dedicated prop firm dashboard. This tool consolidates auto-liquidation levels and funding progress into a single window for easier tracking. A verified user, The Trading Apprentice, shared their experience:

"The seamless integration of trade copying and risk management in one convenient dashboard has not only saved me time but also alleviated a great deal of stress".

Conclusion

Indicators TradeCopier delivers dependable performance for futures traders seeking a reliable NinjaTrader trade copier without the hassle of recurring subscription fees. With a lifetime license priced at $175 for the Trade Copier or $295 for the full suite, it eliminates ongoing costs while maintaining high user satisfaction. Its 4.8/5 Trustpilot rating, based on over 200 reviews, underscores its strong reputation among traders. Features like one-click Rithmic resync and Executions Mode tackle synchronization challenges effectively, ensuring smooth operation.

The tool’s performance gets a noticeable boost when paired with a high-performance VPS. Fred Harrington, Founder of Vetted Prop Firms, highlights this synergy:

"Affordable Indicators leads with tight NinjaTrader integration… using a high‑spec VPS like QuantVPS in Chicago ensures smooth, consistent performance without execution errors".

A Chicago-based VPS with at least 6 CPU cores and 16 GB of RAM is recommended to keep the copier running 24/7 while reducing slippage on fast-moving contracts like NQ or ES. QuantVPS, starting at $59.99 per month, offers ultra-low latency – less than 0.52 ms – to the CME Group exchange. This combination of tools and infrastructure enhances speed and precision, vital for traders targeting optimal execution.

Indicators TradeCopier is particularly suited for futures copy trading in prop accounts, advanced day traders, and users managing signals across multiple platforms like TradingView, NinjaTrader, Tradovate, or Rithmic. For simpler setups with one or two accounts, the $175 option provides the necessary functionality. By combining affordability, precision, and robust risk management, Indicators TradeCopier proves to be a valuable tool for professional futures traders.

FAQs

What are the benefits of choosing a one-time payment model for trade copiers?

Choosing a one-time payment model gives traders a straightforward and upfront cost, removing the hassle of recurring subscriptions. It makes budgeting simpler and eliminates any surprises when it comes to charges.

On top of that, a one-time payment often includes a lifetime license along with continuous updates and support. This ensures lasting value and reliability – a practical option for futures traders who need dependable trade copying tools.

How does Indicators TradeCopier manage risk across multiple trading accounts?

Indicators TradeCopier offers a robust Account Risk Manager designed to simplify risk management across all accounts connected to a master account. Through a centralized dashboard, you can set personalized daily profit targets and loss limits for each account. Once an account reaches its predefined threshold, the system automatically closes all open positions, minimizing further risk.

This tool also caters to prop-firm-specific requirements, such as daily loss caps and profit objectives, allowing you to track these metrics in real time. If an account breaches its risk parameters, the copier immediately sends a command to close positions, ensuring dependable risk control throughout your portfolio. This feature empowers futures traders to expand their strategies while keeping risk firmly under control.

Why is a VPS essential for getting the best performance from Indicators TradeCopier?

Using a Virtual Private Server (VPS) is key to getting the best performance out of the Indicators TradeCopier. A VPS provides a fast and stable trading environment with incredibly low latency – often under 1 millisecond – to major futures exchanges. This ultra-fast connection ensures trade signals are transmitted and executed almost instantly, reducing slippage and keeping copied trades closely in sync with the master account.

Another major advantage of a VPS is its ability to shield your trading setup from local issues like power outages, internet disruptions, or computer crashes. With its 24/7 uptime and dependable performance, a VPS keeps the TradeCopier running smoothly and consistently. This means you can focus on your trading strategies without worrying about unexpected technical problems. In the fast-moving world of futures trading, a VPS is an essential tool for reliable and seamless trade copying.