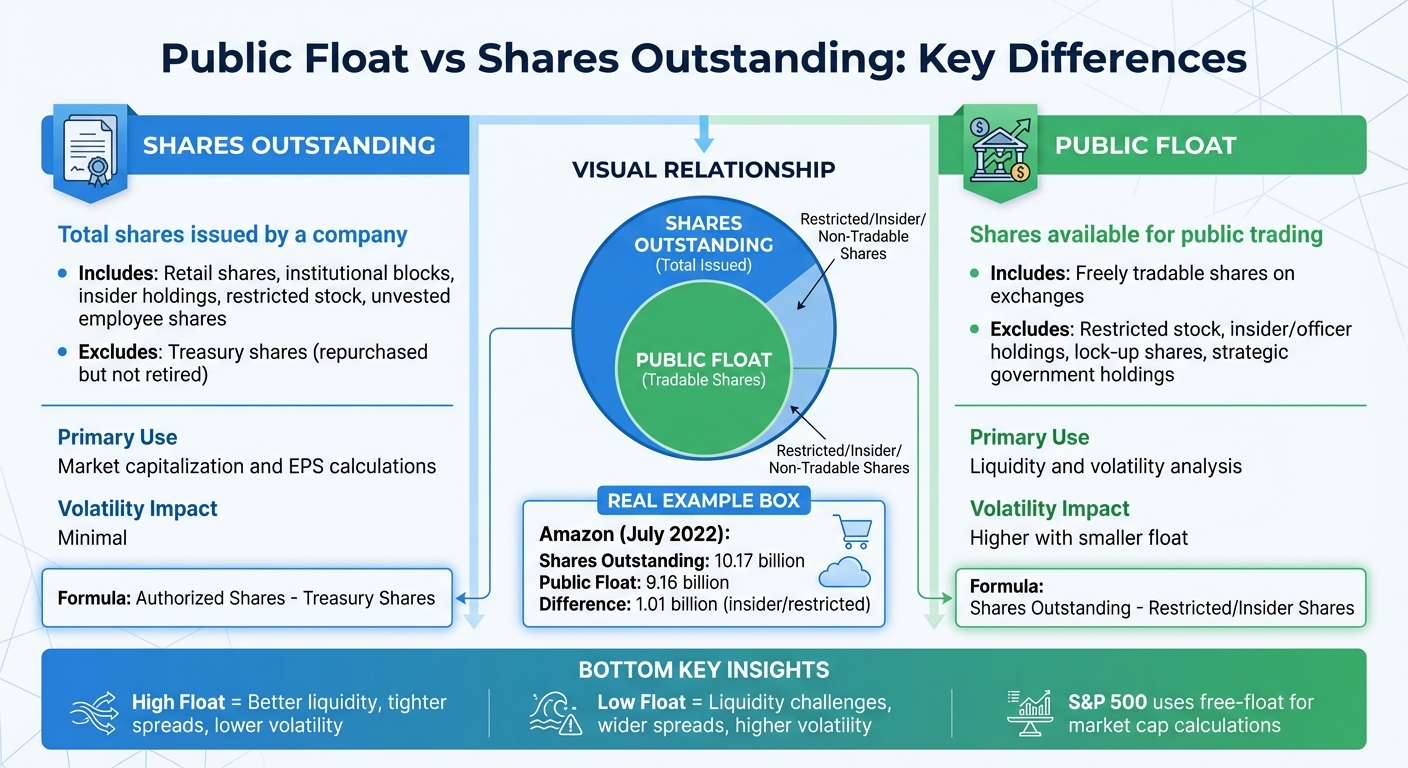

Shares outstanding and public float are two key metrics that help investors and traders evaluate stocks. While they may seem similar, they serve different purposes:

- Shares Outstanding: The total number of shares a company has issued, including those held by insiders, institutions, and the public. This number is used to calculate market capitalization and earnings per share (EPS).

- Public Float: A subset of shares outstanding, representing only the shares available for public trading. It excludes insider holdings, restricted shares, and lock-up shares.

Why It Matters:

- Liquidity: Stocks with a higher float are easier to trade, with tighter bid-ask spreads. Low-float stocks can face liquidity challenges.

- Volatility: Low-float stocks are more prone to price swings due to limited supply.

- Market Indices: Indexes like the S&P 500 base market cap calculations on public float, not total shares outstanding.

Key Example: Amazon in 2022 had 10.17 billion shares outstanding but only 9.16 billion in public float, highlighting the difference between the two metrics.

Quick Comparison:

| Feature | Shares Outstanding | Public Float |

|---|---|---|

| Definition | Total shares issued | Shares available for public trading |

| Includes | Retail, institutional, insider holdings | Freely tradable shares |

| Excludes | Treasury shares | Insider, restricted, lock-up shares |

| Use | Market cap, EPS calculations | Liquidity, volatility analysis |

| Volatility Impact | Minimal | Higher with smaller float |

Knowing the difference between these metrics helps you assess liquidity, anticipate volatility, and make informed trading decisions.

Public Float vs Shares Outstanding: Key Differences Comparison Chart

Definitions and Core Concepts

What Is Public Float?

Public float, often referred to as "floating stock" or "free float", represents the portion of a company’s shares that are available for public trading on the open market. It excludes shares held by insiders and those restricted by lock-up agreements after an IPO.

To calculate public float, subtract restricted shares – those held by insiders, company officers, directors, company-sponsored foundations, and employee stock ownership plans (ESOPs) – from the total shares outstanding. According to the U.S. Securities and Exchange Commission, public float is defined as "the product of the number of common shares held by non-affiliates multiplied by the market price".

What Are Shares Outstanding?

Shares outstanding refers to the total number of shares a company has issued and are currently held by all shareholders. This includes retail investors, institutional investors, insiders, and employees. It’s a key figure in determining metrics like market capitalization and earnings per share (EPS). Shares outstanding encompass restricted stock, unvested employee shares, and institutional blocks.

The formula for calculating shares outstanding is straightforward: Issued Shares minus Treasury Shares (shares the company has repurchased but not retired).

Understanding these terms is essential for grasping how they influence trading dynamics and market behavior.

How They Relate to Each Other

Public float is essentially a subset of shares outstanding, representing only the shares available for public trading. The difference between the two metrics underscores the role of restricted or non-public holdings in shaping market activity.

Take Robinhood’s IPO in 2021 as an example. The company floated just 7% of its total shares, leaving a significant portion outside public reach. This distinction is also evident in market indices like the S&P 500, which calculate market capitalization based on free-float methods that only account for publicly available shares.

| Metric | Includes | Excludes |

|---|---|---|

| Shares Outstanding | Retail shares, institutional blocks, insider holdings, restricted stock, unvested employee shares | Treasury shares (repurchased but not retired) |

| Public Float | Shares freely tradable by the public on exchanges | Restricted stock, insider/officer holdings, lock-up shares, strategic government holdings |

Key Differences Between Public Float and Shares Outstanding

Side-by-Side Comparison

Let’s break down the practical differences between shares outstanding and public float, building on their definitions.

Although both measure a company’s shares, they serve distinct purposes in trading. Shares outstanding refers to the total number of shares a company has issued, including those held by insiders, institutions, and the public. On the other hand, public float focuses solely on the shares available for trading on the open market.

The calculation methods differ as well. Shares outstanding subtracts treasury shares from the total authorized shares, while public float excludes restricted and insider-held shares from the total shares outstanding.

| Feature | Shares Outstanding | Public Float |

|---|---|---|

| Definition | Total shares issued and held by all stockholders | Shares available for public trading |

| Calculation | Authorized Shares – Treasury Shares | Shares Outstanding – Restricted/Insider Shares |

| Primary Use | Used for market capitalization and earnings per share calculations | Used to assess liquidity and volatility |

| Volatility Impact | Minimal impact as a standalone measure | Lower float often results in higher volatility |

| Institutional Interest | Less relevant for timing trades | High float attracts institutions trading large volumes |

These differences significantly influence how markets behave, as explained below.

Impact on Market Dynamics

The size of a company’s public float plays a crucial role in its trading behavior. Liquidity, for instance, relies heavily on the number of shares available for public trading. Stocks with a high float tend to have tighter bid-ask spreads, making trades smoother and more efficient. In contrast, low-float stocks – typically with fewer than 10 to 20 million shares – can face liquidity issues, complicating quick trade execution.

Volatility is another key factor tied to float size. Stocks with floats below 50 to 100 million shares are more susceptible to dramatic price swings, as even moderate trading activity can absorb the limited supply. A striking example of this occurred during the Volkswagen short squeeze in October 2008. Porsche disclosed that it controlled 74% of Volkswagen‘s voting shares, leaving just 6% in the public float. The resulting imbalance between supply and demand caused Volkswagen‘s stock price to soar by 400% within days.

Market indices like the S&P 500 account for these dynamics by using free-float market capitalization instead of total market cap. This approach reflects only the shares available to investors, offering a clearer picture of market behavior. Traders often monitor the ratio of public float to shares outstanding; a low ratio can signal heavy insider ownership and potentially higher volatility if those insiders decide to sell.

"The float of a stock refers to the number of shares that are available for public trading. These are shares typically held by regular investors, not company insiders or employees."

- Timothy Sykes, Trader and Educator

TRADING BASICS – Float vs Shares Outstanding #trading #stockstowatch

sbb-itb-24dd98f

How Corporate Actions Affect Public Float and Shares Outstanding

Corporate actions can reshape both shares outstanding and public float, influencing market liquidity and price volatility. Recognizing these changes is essential for predicting price fluctuations and refining investment strategies.

Share Buybacks and New Share Issuance

Share buybacks are one of the most impactful corporate actions. When a company repurchases its own stock, the shares become treasury stock, effectively reducing both shares outstanding and public float. This decrease in tradable shares can tighten supply, potentially boosting earnings per share and increasing price volatility.

On the flip side, new share issuance – whether through secondary offerings, exercised warrants, or stock options – has the opposite effect. It expands both shares outstanding and public float, diluting current shareholders’ stakes. While dilution might raise concerns for some investors, the increased float enhances liquidity, often narrowing bid-ask spreads and making it easier for institutional investors to execute large trades.

The SEC categorizes companies based on public float thresholds:

- Large Accelerated Filers: $700 million or more

- Accelerated Filers: Between $75 million and $700 million

- Non-Accelerated Filers: Less than $75 million

Insider Selling and Lockup Expirations

Insider activity and lockup expirations also play a major role in shaping public float. When insiders sell shares or when restricted shares from IPO lockup periods become tradable, public float increases. However, these changes do not affect the total shares outstanding. IPO lockup periods generally last between 90 and 180 days, and their expiration can lead to a sudden influx of shares available for trading.

Take General Electric as an example. In September 2023, the company had 1.088 billion shares outstanding, but only about 260 million shares – roughly 24% – were part of the public float.

"Shares outstanding tells you the size of the pie, but float tells you how much is actually on the table."

- StockTitan Research Team

Insider selling can sometimes raise red flags for investors, even though such actions may simply reflect personal financial decisions rather than negative company sentiment.

Practical Applications for Traders and Investors

Evaluating Liquidity and Volatility

The size of a company’s public float plays a key role in how easily trades can be executed without causing noticeable price changes. A larger float means more shares are available for trading, leading to increased liquidity and narrower bid-ask spreads. For instance, as of July 13, 2022, Amazon had 10.17 billion shares outstanding, with a public float of 9.16 billion shares. This massive pool allowed institutional investors to trade large volumes without significantly impacting the stock price.

On the other hand, smaller floats often result in higher volatility. With fewer shares available, trading pressure can quickly lead to sharp price movements. This is why day traders are often drawn to low-float stocks – they offer the potential for quick and dramatic price swings. In contrast, institutional investors typically prefer high-float stocks, as they can trade larger amounts without disrupting the market.

To assess liquidity, divide the public float by the total shares outstanding. A low float-to-outstanding ratio suggests high insider control, which can lead to more pronounced price swings, wider bid-ask spreads, and increased slippage risk. This ratio is not just a tool for evaluating trade execution but also provides insights into broader market valuation.

Market Capitalization and Ownership Analysis

Market capitalization, calculated by multiplying the share price by the total shares outstanding, reflects a company’s overall value. However, free-float market capitalization – based only on publicly tradable shares – offers a more realistic view of a stock’s tradable value. For example, indices like the S&P 500 rely on free-float capitalization to determine stock weightings. This means that only the publicly available shares, not the total outstanding shares, influence a company’s role in the index.

By comparing public float to shares outstanding, you can gauge insider control. A higher float relative to outstanding shares indicates that more shares are unrestricted and available for trading, making the stock more liquid.

"If the float is high to the number of outstanding shares, it means a large number of shares are unrestricted and available for trading. The stock is considered liquid." – Investopedia

Position Sizing and Strategy Development

Understanding a stock’s liquidity and ownership structure is crucial for effective position sizing and risk management. For low-float stocks, it’s wise to limit position size due to their higher volatility and the risk of being trapped in a position when liquidity dries up. Smaller positions make it easier to exit without significantly affecting the stock price.

In contrast, high-float stocks can handle larger positions because their price stability accommodates substantial order flow without dramatic swings. When trading, adjust your stop-loss orders based on the stock’s float characteristics: use wider stops for low-float stocks to account for volatility and tighter stops for high-float stocks.

Corporate actions can also impact float and liquidity. Share buybacks reduce both float and outstanding shares, tightening supply and potentially increasing volatility. Conversely, new share issuances or warrant exercises expand the float, which can dilute existing positions.

Keep an eye on lock-up expirations for newly public companies. These companies often start with a minimal float, leading to heightened volatility. Once the lock-up period ends – usually 90 to 180 days after an IPO – the release of additional tradable shares can increase supply, putting downward pressure on prices and reshaping the stock’s liquidity profile.

Conclusion

Shares outstanding represent all the issued shares of a company, including those held by insiders, while the public float focuses only on shares available for trading. A significant difference between these numbers often indicates strong insider control, which can lead to less liquidity and more unpredictable price movements.

When analyzing a stock, shares outstanding are crucial for calculating metrics like market capitalization and earnings per share (EPS). On the other hand, the float provides insight into trading liquidity and potential price volatility. For day traders, low-float stocks offer opportunities with heightened volatility – though they come with risks like wider spreads and higher slippage. In contrast, long-term investors generally prefer high-float stocks for their stability and smoother trading experience. It’s worth noting that benchmarks like the S&P 500 rely on free-float market capitalization to better capture the actual tradable value of companies.

FAQs

What is the impact of public float on a stock’s liquidity and price volatility?

The public float, or the number of shares available for trading, is a crucial factor in shaping a stock’s liquidity and volatility. A smaller float often means lower liquidity, as there are fewer shares available to trade at any given moment. This limited availability can cause more dramatic price swings when demand shifts, leading to increased volatility.

For both investors and traders, knowing a stock’s public float is essential. Stocks with a high float usually have more stable prices and are easier to trade. On the other hand, low float stocks carry higher risks but can also offer the chance for significant price movements.

Why do market indices rely on public float instead of total shares outstanding?

Market indices rely on public float because it represents the shares actively available for public trading. Unlike total shares outstanding, public float excludes restricted or closely held shares, offering a clearer picture of a stock’s liquidity and trading activity.

By using public float, indices can more accurately reflect the portion of a company’s stock that influences market behavior, ensuring their calculations align with real trading conditions and investor participation.

How do share buybacks affect public float and shares outstanding?

When companies engage in share buybacks, they remove shares from the open market, which reduces the public float – the number of shares available for trading. However, unless those repurchased shares are officially canceled, the total shares outstanding usually stays the same. This decrease in public float can affect stock liquidity and potentially lead to greater price swings, which are key considerations for both investors and traders.