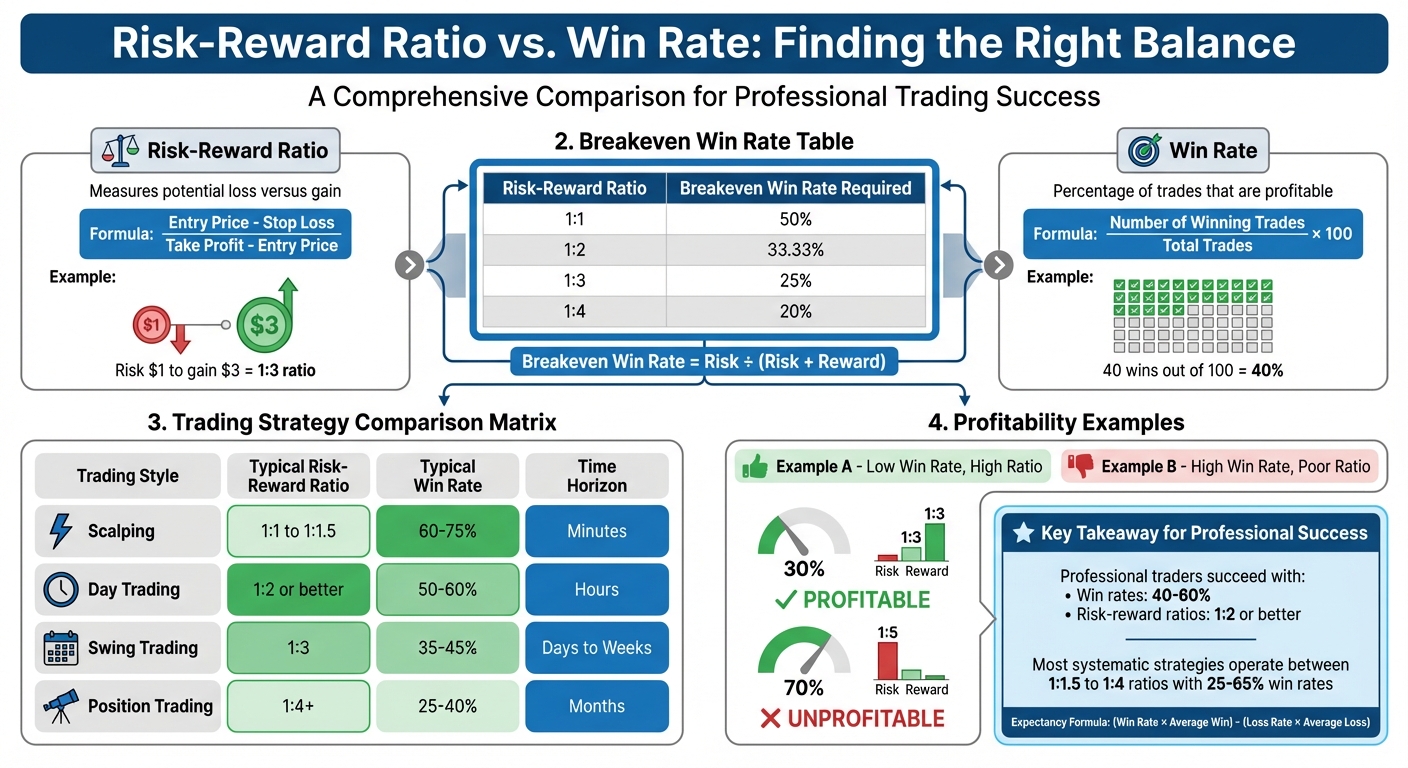

Balancing risk-reward ratio and win rate is the cornerstone of successful trading. While many traders focus on winning more often, profitability depends on how much you gain versus how much you risk. For example:

- A 30% win rate can still yield profits with a 1:3 risk-reward ratio.

- Conversely, a 70% win rate may lead to losses if your losses outweigh your wins.

The key takeaway? It’s not about how often you win but how well you manage risk and rewards.

Here’s what matters most:

- Risk-Reward Ratio: Measures potential loss versus gain. Example: Risk $1 to gain $3 = 1:3 ratio.

- Win Rate: Percentage of trades that are profitable. Example: 40 wins out of 100 = 40%.

- Breakeven Win Rate: The minimum win rate needed to avoid losses, calculated as Risk ÷ (Risk + Reward).

Professional traders often succeed with win rates between 40-60% and risk-reward ratios of 1:2 or better. Tools like TradingView and TraderSync can help track and refine these metrics.

The secret to consistent trading success lies in combining these metrics effectively, not chasing high win rates or extreme ratios alone.

Risk-Reward Ratio vs Win Rate: Trading Strategy Comparison Chart

Risk to Reward Ratio: The #1 Trading Secret Beginners Must Know (Step-by-Step Guide)

What Are Risk-Reward Ratio and Win Rate?

The risk-reward ratio (RRR) measures how much potential loss you’re taking on compared to the potential gain in a trade. It’s calculated using this formula:

Risk-Reward Ratio = (Entry Price – Stop Loss) / (Take Profit – Entry Price).

Here’s an example: Imagine you buy at $100, set a stop-loss at $95, and aim for a profit target of $110. You’re risking $5 to potentially gain $10, which gives you a 1:2 ratio. In simple terms, for every $1 you risk, you could make $2.

The win rate, on the other hand, focuses on how often your trades are profitable. The formula is:

Win Rate = (Number of Winning Trades / Total Number of Trades) × 100.

For instance, if you make 100 trades in a month and 40 turn a profit, your win rate is 40%. While this shows how frequently you win, it doesn’t reveal how much you’re gaining or losing on average.

It’s also worth noting the difference between the win rate and the win/loss ratio. The win/loss ratio compares the number of wins to losses. For example, 60 wins and 40 losses would give you a 1.5 win/loss ratio. However, even with a high win/loss ratio, you could still lose money if your average losses are larger than your average gains.

These metrics are crucial for calculating the breakeven win rate, which tells you the minimum win rate needed to avoid losses. The formula is:

Breakeven Win Rate = Risk / (Risk + Reward).

For example, with a 1:2 risk-reward ratio, you’d need to win more than 33.33% of your trades to break even. On the other hand, a 1:1 ratio requires a win rate above 50%. This highlights why traders can still profit with win rates between 25% and 65%, as long as they balance these metrics effectively.

Grasping these concepts is key to refining your trading strategies and ensuring they align with your risk management goals.

1. Risk-Reward Ratio

How to Calculate It

Figuring out the risk-reward ratio is pretty simple. Start by calculating your potential risk: subtract your stop-loss price from your entry price. Then, determine your potential reward: subtract your entry price from your target price. Finally, divide the reward by the risk to get your ratio. For example, if you’re risking $500 to potentially earn $1,500, your ratio is 1:3. This number helps you decide if a trade offers a good balance of risk and reward before you commit your money.

How It Affects Your Profits

Once you know the ratio, it helps you understand your breakeven win rate. For instance, with a 1:2 ratio, you need to win more than 33.33% of your trades to break even. A 1:3 ratio lowers that threshold to just 25%. The big takeaway? Profitability isn’t just about being right often – it’s about making sure your winning trades outweigh your losing ones. This shifts the focus from aiming for frequent wins to ensuring your gains are large enough to cover your risks.

How It Fits Into Trading Strategies

Different trading styles call for different ratios. Scalpers, who make quick trades throughout the day, might use tighter ratios like 1:1.5 since they rely on a high win rate. Day traders often aim for a 1:2 ratio or better to capitalize on short-term price moves. Swing traders, who hold positions for several days or weeks, might target a 1:3 ratio because they can afford a lower win rate. Position traders, who hold trades for much longer periods, typically look for ratios of 1:4 or higher to make the extended exposure worthwhile.

Tools to Apply It

There are plenty of tools to help you apply the risk-reward ratio effectively. Platforms like TradingView offer a "Long/Short Position" tool that visually maps out your ratio on the chart as you adjust your stop-loss and target levels. For quick calculations, online tools like the Smart Trading Software calculator let you plug in your entry, stop-loss, and target prices to instantly get your ratio and breakeven win rate. TrendSpider takes it a step further with features like the "Strategy Tester" and "AI Strategy Lab", allowing you to backtest different ratio setups without needing coding skills. Another popular method involves using the Average True Range (ATR) indicator to set dynamic stops and targets. For example, you might place a stop-loss at 2× ATR and a target at 4× ATR to adjust for market volatility. These tools streamline the process, helping you stick to your risk-reward strategy consistently across trades.

sbb-itb-24dd98f

2. Win Rate

After exploring risk-reward ratios, understanding win rate is another critical piece of the puzzle for evaluating trading performance.

How to Calculate It

Win rate is the percentage of trades that result in a profit. To calculate it, divide the number of winning trades by the total number of trades, then multiply by 100. For instance, if you have 60 successful trades out of 100, your win rate is 60%. While this metric shows how often you win, it doesn’t tell the full story of profitability. Even with a 70% win rate, you could lose money if your average losses are larger than your average wins. For a clearer picture of success, win rate must be considered alongside trade size and risk-reward ratios.

How It Affects Your Profits

Win rate works hand in hand with your risk-reward ratio to determine overall profitability. For example, with a 1:1 risk-reward ratio, you’d need at least a 50% win rate just to break even. Most professional traders operate with win rates between 40% and 60%, depending on their strategies. Interestingly, even a win rate as low as 33% can be profitable if the reward-to-risk ratio is 2:1 or higher. As HorizonAI points out:

A 30% win rate can be profitable if winners are 3x bigger than losers. A 70% win rate can lose money if losers are 5x bigger than winners.

How It Fits Into Trading Strategies

Your trading style will naturally influence your win rate. Scalpers and mean reversion traders often achieve higher win rates – typically between 60% and 75% – by focusing on small, frequent price movements. On the other hand, trend followers tend to have lower win rates, around 40%, but make up for it with much larger gains when trends develop. When choosing a strategy, consider how often you’re comfortable experiencing losses. A win rate above 75% might sound ideal, but in some cases – like backtests – it could signal over-optimization.

Tools to Apply It

Tracking win rates accurately requires diligent record-keeping. Many traders start with tools like Excel or Google Sheets to create custom journals, logging details like trade date, entry price, stop-loss, take-profit, and outcomes. While this method offers flexibility, it can be time-consuming – up to 15 to 20 hours per month – and prone to manual errors. Automated platforms such as TraderSync and TraderLens simplify the process by importing trade data and calculating metrics like win rates and profit factors in real time. These tools cut tracking time to just 2 to 5 minutes a day while maintaining over 95% accuracy. Additionally, TradingView’s Strategy Tester includes built-in calculators for win rate and other performance metrics during backtesting. For meaningful adjustments, analyze at least 101 trades to achieve 70% statistical confidence.

Strengths and Weaknesses of Each Metric

Now that we’ve covered how to calculate both risk-reward and win rate, let’s dive into the strengths and weaknesses of each metric.

The risk-reward ratio offers flexibility for various trading strategies. For instance, with a 3:1 ratio, a single win can offset multiple losses. However, achieving higher ratios often requires tight stop losses, which can be highly sensitive to market volatility. This may lead to frequent exits, testing a trader’s mental resilience. Additionally, chasing extremely high ratios, like 1:10 or more, usually results in very low win rates. This can be discouraging during extended drawdowns, potentially causing traders to abandon their strategy altogether.

On the other hand, a high win rate can instill confidence and promote steady account growth. Scalpers, for example, often aim for win rates above 60% to secure consistent, smaller gains. But maintaining such accuracy is tough, and focusing solely on win rate can mask the risk of outsized losses. In these cases, a few large losses can wipe out the profits from numerous smaller wins. Overconfidence from a winning streak can also lead to "revenge trading" after experiencing a significant loss.

| Metric Priority | Profitability Driver | Best Strategy Options | Risk Control Approach |

|---|---|---|---|

| High Risk-Reward (1:3+) | Large, infrequent "home run" trades; one win covers many losses | Swing trading, position trading, trend following | Tight stop losses; sensitive to market volatility |

| High Win Rate (60%+) | Frequent small gains; requires strict loss capping | Scalping, day trading, mean reversion | Wider stop losses or high-probability entries |

Neither metric alone guarantees success. Instead, combining the two forms the backbone of a strong trading strategy. This is where expectancy comes into play – a formula that merges both metrics: (Win Rate × Average Win) – (Loss Rate × Average Loss). For example, a trader with a 33% win rate and a 5:1 risk-reward ratio can still achieve a 30% return over 30 trades, even with 20 losses. Conversely, a 60% win rate without proper risk management could still result in losses.

Interestingly, most successful systematic strategies strike a balance, operating with risk-reward ratios between 1:1.5 and 1:4 and win rates ranging from 25% to 65%. Understanding these trade-offs is essential for building a well-rounded and sustainable trading approach.

Conclusion

To achieve a disciplined and profitable trading approach, it’s crucial to balance your risk-reward ratio with your win rate. As highlighted earlier, the size of your wins often outweighs how frequently you win. This principle is at the core of effective risk management and should align with your trading style, mental resilience, and the market conditions you face.

Start by calculating your breakeven win rate using the formula: 1/(1 + Risk-Reward Ratio). This simple calculation helps ensure that your strategy matches your risk tolerance and goals.

Your trading style also plays a key role. Scalpers, for instance, often work with lower risk-reward ratios (like 1:1 or 1:1.5) but rely on higher win rates. Conversely, swing traders can succeed with win rates between 35–45% when targeting higher ratios, such as 1:3 or more. Choose a strategy that suits your personality – whether you prefer quick feedback or have the patience to endure drawdowns.

Tracking your trades is another essential step. Use this formula to calculate expectancy:

(Win Rate × Average Win) – (Loss Rate × Average Loss).

Aim for a sample size of at least 100 trades to gather meaningful statistics and refine your strategy. To further improve, consider setting dynamic targets, like ATR-based levels, for stop-losses. This ensures stops are placed at logical points that invalidate your setup, rather than arbitrary levels prone to market noise.

FAQs

How can I find the right risk-reward ratio for my trading strategy?

Finding the right risk-reward ratio for your trading strategy is a personal process, shaped by your trading style, win rate, and comfort with risk. There’s no one-size-fits-all ratio – it all comes down to aligning it with your goals and approach.

A good starting point is to review your past trades or backtest your strategy. This can help you identify what ratios have worked well historically. For example, a higher ratio like 1:3 means you can afford fewer winning trades and still stay profitable. On the other hand, lower ratios like 1:1 or 1:2 demand a higher win rate to achieve similar results. Testing these ratios in a demo account is a low-pressure way to figure out what feels right for you.

The ideal risk-reward ratio is the one that matches your confidence in your trade setups, your ability to read the market, and your overall risk management strategy. It’s all about finding that sweet spot where profitability meets your unique trading style.

Can you still be profitable in trading with a low win rate?

Yes, you can still make a profit in trading even with a low win rate, as long as your risk-reward ratio works in your favor. This means your winning trades need to generate enough profit to cover the losses from your losing trades.

For instance, imagine your average winning trade brings in $300, while your average losing trade costs you $100. In this case, you would only need to win about 25% of your trades just to break even. By prioritizing risk management and targeting larger rewards on successful trades, it’s possible to maintain consistent profitability, no matter your win rate.

What tools can I use to track and improve my risk-reward ratio and win rate in trading?

Tracking and improving your risk-reward ratio and win rate plays a key role in achieving consistent success in trading. Fortunately, there are tools available that simplify this process, helping you calculate, analyze, and adjust these metrics to align with your trading objectives.

Most trading platforms come with built-in calculators where you can input your stop-loss and take-profit levels to determine your risk-reward ratio instantly. Beyond these, standalone tools are available that focus on calculating breakeven win rates and optimizing trade setups. These tools provide valuable insights into how you can balance risk and reward effectively while aiming for steady profitability.

By leveraging these resources, traders can make smarter decisions, refine their strategies, and enhance overall performance. Adding such tools to your routine can significantly improve your ability to manage risk and achieve more consistent trading outcomes.