Alpha Futures Prop Firm payout rules can make or break your trading experience. Here’s what you need to know:

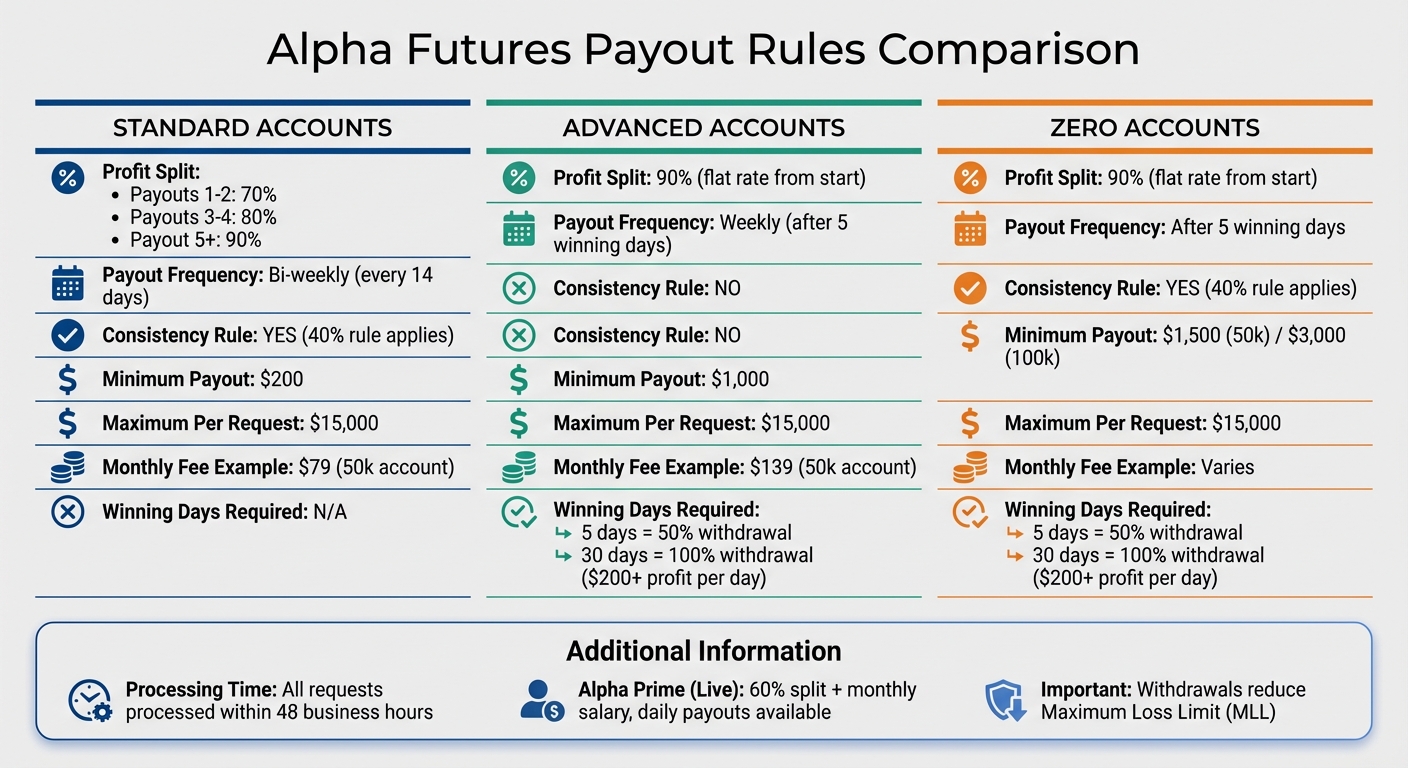

- Account Types & Profit Splits:

- Standard Accounts: Start with a 70% profit split, increasing to 90% after four payouts.

- Advanced Accounts: Flat 90% profit split from the start but higher monthly fees.

- Live Funding (Alpha Prime): Includes a 60% split and monthly salary.

- Payout Frequency:

- Standard Accounts: Bi-weekly payouts.

- Advanced Accounts: Weekly payouts once five winning days ($200+ profit each) are achieved.

- Key Rules:

- Consistency Rule (Standard & Zero Accounts): No single day’s profit can exceed 40% of total net profit since the last withdrawal.

- Advanced Accounts: No consistency rule; instead, payouts depend on the number of winning days.

- Limits:

- Minimum payouts: $200 (Standard), $1,000 (Advanced), $1,500–$3,000 (Zero).

- Maximum payout per request: $15,000 for all accounts.

- Processing:

- All requests are processed within 48 business hours.

Important Note: Withdrawals reduce your Maximum Loss Limit (MLL). Withdrawing all profits can lead to account closure if your MLL is reached. Plan withdrawals carefully to maintain account stability.

This system promotes disciplined trading while rewarding consistent performance. Ready to dive deeper? Let’s break it all down.

Alpha Futures Account Types Comparison: Profit Splits, Payout Frequency, and Requirements

How Alpha Futures Calculates Trader Earnings

Profit Splits and Account Tiers

Alpha Futures structures trader earnings based on account type, with profit splits varying accordingly. For Standard accounts, traders start with a 70% profit split on their first two payouts. This increases to 80% for the third and fourth payouts and eventually reaches 90% for all payouts after that. On the other hand, Advanced accounts offer a flat 90% split right from the start. However, these accounts come with higher monthly fees – for instance, a 50k Advanced account costs $139 per month, compared to $79 for a Standard account.

For those transitioning to Alpha Prime (Live) funding, the payout structure changes significantly. Live traders receive a 60% profit split along with a monthly salary. As Alpha Futures puts it, "We believe Live Traders should be treated much more like a partnership with both firm and trader benefitting".

Metrics That Influence Payouts

Your payout isn’t just about profit splits – specific metrics also play a key role in determining how much you can withdraw. Standard accounts are subject to a 40% consistency rule, meaning no single day’s profit can exceed 40% of the total net profit since the last withdrawal.

Advanced accounts, by contrast, skip this consistency rule and instead use a winning-day metric. Any day where you earn $200 or more qualifies as a win. After achieving five winning days, you can withdraw 50% of your profits. Once you hit 30 winning days, you’re eligible to withdraw 100% of your profits, up to a maximum of $15,000 per request.

Both account types have minimum withdrawal thresholds: $200 for Standard accounts and $1,000 for Advanced accounts. Additionally, withdrawal requests are capped at $15,000 for both account types.

Payout Schedules and Request Processes

Payout Timing and Frequency

The timing of your payouts depends on the type of account you have. For Standard accounts, payouts follow a bi-weekly schedule. You can request a withdrawal every 14 days, starting from the date of your first qualified trade. The request window for these payouts opens at 12:00 AM UTC and closes at 11:59 PM UTC on your designated payout day, so it’s important to pay attention to the timing.

For Advanced and Zero accounts, payouts are unlocked once you achieve five winning trading days, with each day generating at least $200 in profit. These days don’t have to be consecutive, giving you the flexibility to meet the requirement at your own pace. After meeting this milestone, you can request to withdraw 50% of your profits. For Advanced accounts, this withdrawal is capped at $15,000 per request, while Zero accounts have varying limits based on the size of your account. Once you accumulate 30 winning days, you become eligible to withdraw 100% of your profits, subject to the withdrawal limits set for your account.

If you’re part of the Alpha Prime (Live) funding program, the process is even simpler. According to Benjamin Chaffee from Alpha Futures:

"Live Traders are eligible for daily payouts, very simple rules: if you made money, you can request a payout!"

Next, let’s walk through how to request your payout using your dashboard.

How to Request a Payout

Requesting a payout is straightforward and managed entirely through your Alpha Futures dashboard. For Standard account holders, log in during your assigned payout window (12:00 AM–11:59 PM UTC) and enter the amount you’d like to withdraw. The payout you receive will reflect your current profit split.

If you hold an Advanced or Zero account, there’s no fixed time window for submitting a request. Once you’ve completed your five winning trading days, you can log in and submit your payout request at any time. Regardless of your account type, all requests are processed within 48 business hours or less. During this processing period, your account may be temporarily locked. This step helps secure your profits and ensures the calculations are accurate.

Payout Rules, Limits, and Fees

Consistency Requirements and Daily Profit Caps

Alpha Futures applies a 40% consistency rule to Standard and Zero Qualified accounts. This means that no single trading day’s profit can exceed 40% of your total net profits since your last payout. If you have a particularly strong trading day that crosses this threshold, your account remains intact, but the payout option will be temporarily disabled. The button becomes available again once your "best day" percentage drops below the 40% mark. This approach ensures that withdrawals reflect your overall trading performance and strategy.

For traders using Advanced Qualified accounts, there’s no consistency rule, offering complete freedom in daily trading performance. Benjamin Chaffee of Alpha Futures explains:

"If you make more than 40% in a single day, your account will NOT be breached, but you will need to continue to trade and make more profit until the rule is satisfied."

To help traders manage this rule, Alpha Futures offers a consistency calculator at consistencycalculator.alpha-futures.com. This tool allows you to track your "best day" percentage in real time. The consistency rule resets after every withdrawal request, giving you a clean slate for each payout cycle. With these rules in place, the next step is understanding withdrawal limits and fees.

Withdrawal Limits and Processing Fees

In addition to consistency rules, it’s important to know the withdrawal limits and any associated fees. For Standard accounts, the minimum payout is $200, with a maximum limit of $15,000 per request. Advanced accounts require a minimum of $1,000, while Zero accounts have higher minimums – $1,500 for 50K accounts and $3,000 for 100K accounts. The same $15,000 cap applies across all account types.

Earnings are primarily reduced by the profit split. Standard accounts follow a tiered structure: the first two payouts are split 70/30 in your favor, the third and fourth payouts increase to 80/20, and from the fifth payout onward, you keep 90% of the profits. Advanced and Zero accounts, on the other hand, offer a flat 90% profit split from the start. Notably, there are no additional processing fees deducted from your withdrawals.

Real Payout Scenarios with Examples

Here are two examples to show how payout rules work in real trading situations.

Example 1: Standard Account Bi-Weekly Payout

Imagine a trader with a $50,000 Standard Qualified Account who earns $5,000 in profit over a 14-day period. They check their best day’s profit, which is $1,500 (30% of their total profit), and confirm it meets the 40% consistency rule. This makes them eligible to withdraw.

For their first payout, the profit split is 70%. They decide to request $2,000, which meets the $200 minimum withdrawal requirement. After applying the 70% split, they receive $1,400.

This example highlights how payouts work for standard accounts. Now, let’s look at a scenario involving an advanced account.

Example 2: Advanced Account with Higher Profits

In this case, a trader has a $50,000 Advanced Qualified Account and earns $5,000 in profit. They achieve five winning days, each with at least $200 in profit. Since they haven’t yet reached the milestone of 30 winning days, a 50% withdrawal cap applies. This means they can request up to $2,500.

Because the advanced account doesn’t have a consistency rule, only the number of winning days is considered for eligibility. With a flat 90% profit split, the trader receives $2,250 from their $2,500 request. Once they hit 30 winning days, they’ll qualify to withdraw up to 100% of their profits, capped at $15,000 per request.

Summary: What Traders Need to Know About Alpha Futures Payouts

Here’s a quick breakdown of the key payout rules for Alpha Futures.

The payout structure at Alpha Futures depends on the type of account you hold. Standard accounts operate on a bi-weekly payout schedule, with a 40% consistency rule and a tiered profit split starting at 70%. Advanced accounts, on the other hand, offer weekly payouts, require no consistency rule, and provide a flat 90% profit split based on accumulating winning days. Meanwhile, Zero accounts also have a 40% consistency rule but maintain a flat 90% profit split.

"Alpha Futures payout policies are extremely straight forward; follow the rules and you will be paid out. No additional hoops to jump through or hidden denials." – Benjamin Chaffee, Author

It’s important to note that withdrawals impact your Maximum Loss Limit (MLL). To avoid triggering account closure, maintain a buffer instead of withdrawing everything. For Advanced and Zero accounts, only days with profits of $200 or more count toward the five winning days needed to qualify for a payout. This system ensures a structured and disciplined trading environment.

All payouts are processed within 48 business hours. Additionally, if you reach a $40,000 payable balance or complete five payouts, your account will be reviewed for Alpha Prime live funding. This upgrade includes a monthly salary and a 60% profit split.

FAQs

What is the consistency rule, and how does it impact payouts for Standard accounts?

The consistency rule for Standard accounts is designed to ensure that no single trading day accounts for more than 50% of your total net profits during the evaluation period. If this condition isn’t met, you won’t qualify for a payout.

This rule promotes steady trading habits and discourages relying heavily on one or two exceptionally profitable days. To be eligible for payouts, aim to distribute your profits more evenly across your trading days.

What are the advantages of upgrading to Alpha Prime Live Funding?

For seasoned traders, upgrading to Alpha Prime Live Funding opens up exciting opportunities. Imagine having access to live trading capital of up to $450,000 – that’s a serious boost to your trading potential. But it’s not just about the numbers; the program is built to support your financial goals with flexible withdrawal options. There are no maximum withdrawal limits, and you can enjoy monthly payouts, providing a steady financial cushion.

What sets Alpha Prime apart is its trader-first approach. Unlike many programs, there are no rigid rules on trading styles – you’re free to trade how you see fit, whether it’s news trading or any other strategy. Forget about consistency requirements or unnecessary restrictions. Plus, the program takes a collaborative approach by sharing both risks and profits, creating a true partnership designed for long-term growth.

If you’re an experienced trader aiming to scale your earnings in a flexible and supportive environment, Alpha Prime Live Funding offers the tools and freedom to succeed.

How can I avoid having my account closed due to the Maximum Loss Limit?

To keep your account running smoothly and avoid closure due to the Maximum Loss Limit (MLL), it’s crucial to manage your losses within the thresholds set by Alpha Futures. The MLL is designed as a safety net to prevent overly large losses. If your losses reach or exceed this limit, your account will automatically close, cutting off your ability to trade.

For instance, certain account types, such as Standard and Zero accounts, come with a Daily Loss Guard. This feature caps your losses at 2% of your initial balance per trading day. If your profit and loss (P&L) hits this limit, all open positions will be closed, and you won’t be able to trade again until the following day.

To avoid interruptions, keep a close eye on your trading activity, respect the loss limits, and plan your trades carefully. By staying within these limits, you’ll ensure your account remains active and in good standing with Alpha Futures.