When it comes to day trading, the timeframe you choose – 1-minute, 5-minute, or 15-minute candlesticks – can significantly impact your strategy, focus, and results. Here’s a quick breakdown:

- 1-Minute Chart: Ideal for those comparing scalping vs day trading to find the right speed for rapid trades. Offers the highest trade frequency but comes with more noise and requires constant attention.

- 5-Minute Chart: Balances trade opportunities and clarity. Reduces noise while still providing enough signals for momentum trading.

- 15-Minute Chart: Best for trend-focused traders who prefer fewer, more reliable setups. Easier to manage but requires patience and larger stop losses.

Each timeframe has trade-offs in terms of speed, mental focus, and hardware needs. Your choice should align with your trading style and resources.

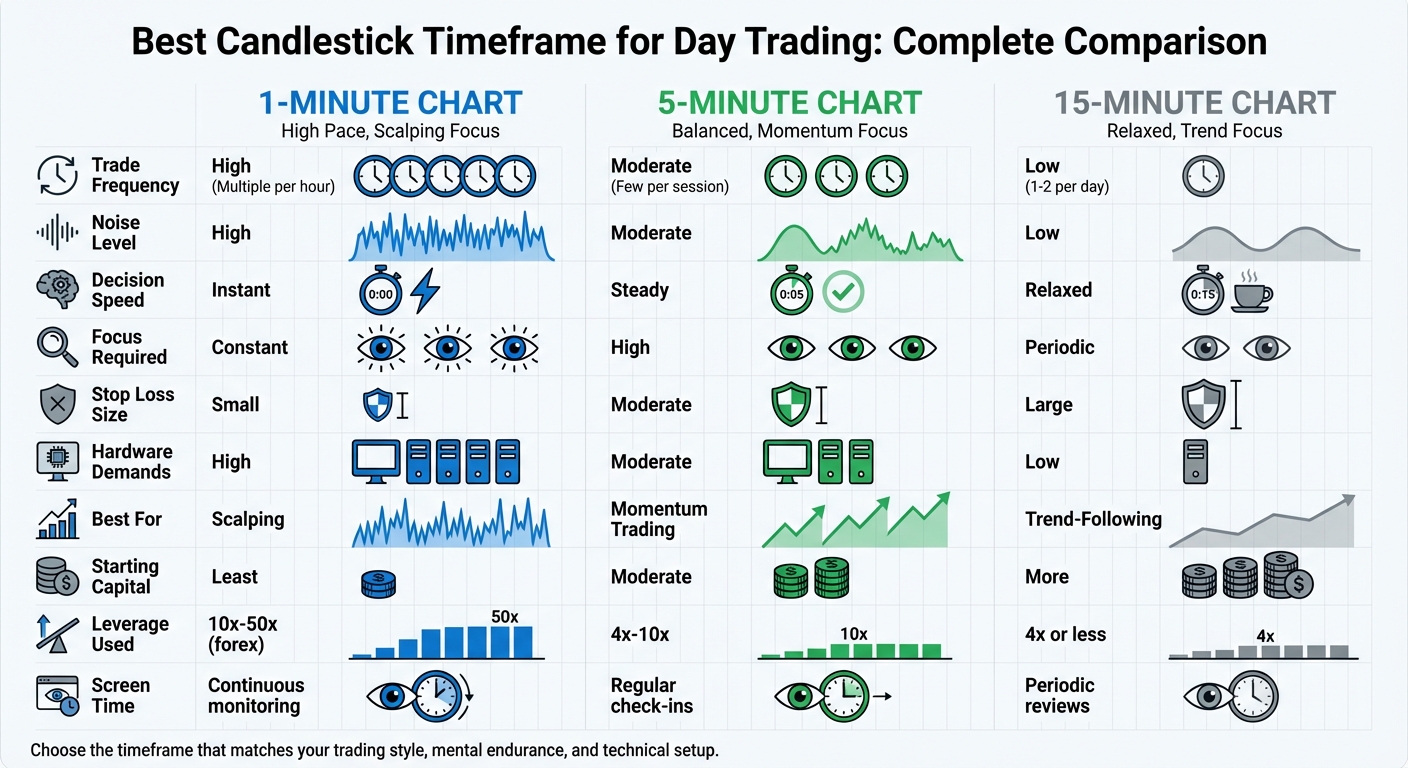

Quick Comparison

| Factor | 1-Minute | 5-Minute | 15-Minute |

|---|---|---|---|

| Trade Frequency | High | Moderate | Low |

| Noise Level | High | Moderate | Low |

| Decision Speed | Instant | Steady | Relaxed |

| Focus Required | Constant | High | Periodic |

| Stop Loss Size | Small | Moderate | Large |

| Hardware Demands | High | Moderate | Low |

| Best For | Scalping | Momentum Trading | Trend-Following |

Choose the timeframe that matches your trading goals, mental endurance, and technical setup. The rest of the article explains how each timeframe works and its specific pros and cons in detail.

Day Trading Timeframe Comparison: 1-Minute vs 5-Minute vs 15-Minute Charts

Best Time Frames for Day Trading Explained | 1-Min vs 5-Min vs 15-Min Charts

sbb-itb-24dd98f

1-Minute Candlestick Timeframe

The 1-minute chart creates a new candlestick every 60 seconds, making it one of the fastest-paced environments for trading. Scalpers and day traders thrive here, capitalizing on small price movements within tight timeframes.

Because new data is generated every minute, traders get an abundance of trade signals compared to longer timeframes. This granularity allows for pinpointing entry and exit points with precision. However, this rapid pace comes with a challenge: high market noise. Random price fluctuations can easily trigger false signals, making it harder to distinguish genuine trends.

"Trading the one-minute requires nearly constant attention while trading, since bars/candles are generated every minute and trade signals can occur often."

– Cory Mitchell, CMT, Founder, TradeThatSwing

The need for split-second decision-making and constant monitoring can quickly lead to mental fatigue. To avoid burnout, many experienced traders limit their sessions to 1–2 hours of focused trading rather than attempting to trade all day.

Pros and Cons of 1-Minute Charts

| Advantages | Disadvantages |

|---|---|

| High number of trade opportunities per session | Significant market noise and false signals |

| Small stop losses allow for larger position sizes | Requires constant attention and focus |

| Quick feedback on trade outcomes | Can lead to mental fatigue and stress |

| Precise timing for entries and exits | Strategies from longer timeframes often don’t apply |

| Lower capital needed to start | Risk of fast losses without strong discipline |

One standout feature of the 1-minute chart is its efficiency with capital. Tight stop losses – sometimes just a few cents or pips – let traders manage risk effectively, often keeping it below 1% per trade. This setup allows for larger position sizes. For instance, Forex traders can use leverage of 10x, 20x, or even 50x while maintaining controlled risk. Stock traders, on the other hand, typically operate within 4x leverage limits.

These factors highlight the importance of having the right tools and systems in place. Next, let’s explore how 1-minute trading impacts hardware and execution.

How 1-Minute Charts Affect Trade Execution and Hardware Needs

Trading on 1-minute charts demands speed and precision, not just from the trader but also from their equipment. Trade signals appear and vanish in seconds, requiring immediate decisions and quick order execution. Staying laser-focused on the screen during active trading is critical – any distraction could mean missing a profitable trade or failing to exit a losing one.

"The detailed resolution of the [1-minute] chart allows for identifying numerous trade opportunities throughout the trading day."

– Dan Buckley, Chief Analyst, DayTrading.com

Your computer and trading platform must handle the intensity of 1-minute trading. Data streams update far more frequently than on longer timeframes, and your system needs to process this information seamlessly across multiple monitors without lag. Even a brief delay can turn a winning trade into a loss when profit margins are measured in mere cents.

To meet these demands, traders often invest in high-performance setups: fast processors, ample RAM, and solid-state drives are essential. A reliable internet connection is equally critical – any latency could become a costly liability.

Before putting real money into 1-minute trading, it’s vital to test your strategy specifically on this timeframe. Backtesting results from 5-minute or 15-minute charts won’t accurately reflect the unique challenges of 1-minute trading. The noise levels and signal patterns are so different that each timeframe requires its own tailored approach.

5-Minute Candlestick Timeframe

The 5-minute chart strikes a balance between capturing intraday price movements and avoiding the overwhelming noise of 1-minute charts. Each candlestick represents five minutes of trading activity, offering a steady flow of data that retains critical price details without being overly fast-paced.

This timeframe is particularly effective at filtering out the random fluctuations seen in shorter timeframes, making it easier to spot patterns and identify reliable signals. However, the trade-off is fewer opportunities – on average, traders might find only one or two solid setups within a two-hour window.

"The 5-minute chart is for people who want to focus on larger intra-day movements, receiving fewer data points, with moderate position sizes."

– Cory Mitchell, CMT, TradeThatSwing

One key characteristic of the 5-minute chart is that it naturally requires wider stop losses and profit targets. This means traders often need to use moderate position sizes to keep their risk in check.

"With 5-minute candlestick, the traders are more able to identify real market movements, as it is less susceptible to noise or random price fluctuations."

– STARTRADER

Many seasoned traders rely on the 5-minute chart as their primary execution timeframe, while using higher timeframes, like 15 or 30 minutes, to confirm the overall trend.

Pros and Cons of 5-Minute Charts

| Advantages | Disadvantages |

|---|---|

| Reduces market noise for clearer patterns | Fewer trade opportunities compared to 1-minute charts |

| Slower pace aids thoughtful decision-making | Wider stops require more capital per trade |

| Generates more reliable signals than shorter timeframes | Demands focused attention during active trading |

| Allows monitoring of multiple assets simultaneously | Moderate position sizes limit leverage potential |

| Works well with multi-timeframe strategies | Requires strategies tailored to this specific timeframe |

The 5-minute chart is ideal for traders who find 1-minute charts too chaotic but don’t want the slower pace of 15-minute signals. It offers enough market activity to stay engaged without the constant stress of rapid decision-making.

How 5-Minute Charts Affect Trade Execution and Hardware Needs

Trading on a 5-minute timeframe also reduces the strain on your hardware. Since data updates every five minutes rather than every minute, your computer’s CPU and RAM won’t be under as much pressure. This makes it a great choice for setups with multiple monitors where you’re tracking several assets at once.

"Trading the five-minute requires focus, but less constant attention than the 1-minute chart. Candles are forming every five minutes, so there is more time between data points."

– Cory Mitchell, CMT, TradeThatSwing

The extra time between candle formations gives you the chance to thoroughly analyze price patterns before making a move. Waiting for a candle to close can also help you avoid impulsive decisions based on incomplete data, encouraging a more disciplined approach.

To ensure smooth execution, your trading platform should support automated features like stop-loss and take-profit orders. These tools can help you stick to risk management rules, such as limiting your risk to no more than 3% per trade.

When it comes to hardware, the requirements for trading on a 5-minute chart are manageable. While you don’t need the top-tier processors or maximum RAM that 1-minute scalping demands, having a solid-state drive and a reliable internet connection is still crucial for seamless performance.

15-Minute Candlestick Timeframe

The 15-minute chart offers a more measured approach compared to the fast-paced nature of shorter timeframes. Each candlestick here represents 15 minutes of price action, which means fewer data points – just four candles per hour versus the 60 you’d see on a 1-minute chart. This makes it easier to focus on major intraday trends without getting overwhelmed by minor price fluctuations.

This timeframe helps filter out random market noise, allowing traders to identify key support and resistance levels and follow genuine trend movements. However, the trade-off is fewer trading opportunities throughout the day.

"The 10 or 15-minute chart is for people who want to focus on the large price movements throughout the day. They don’t mind waiting longer for trades to open and close. They prefer cleaner movement."

– Cory Mitchell, CMT, TradeThatSwing

Many professional traders favor the 15-minute chart for day trading because it balances short-term trend analysis with reduced market noise. It’s particularly effective in multi-timeframe strategies, where traders use this chart to identify overarching trends and then switch to 5-minute or 1-minute charts for precise entry points.

"Trading on a 15-minute chart provides a balance between capturing short-term price movements and having enough time for analysis and decision-making."

– FXOpen

The slower pace of this chart gives traders ample time – 15 minutes between candle closes – to analyze patterns, review their strategies, and make well-thought-out decisions. This makes it a great fit for those who want to avoid the mental exhaustion of constantly monitoring the market, while still capitalizing on intraday price movements. Below, we’ll explore the advantages, challenges, and technical considerations of using the 15-minute timeframe.

Pros and Cons of 15-Minute Charts

| Advantages | Disadvantages |

|---|---|

| Filters out market noise, making trends easier to spot | Limited to 1-2 trade opportunities per session |

| Less screen time required due to slower pace | Wider stop losses require more capital to manage risk |

| Produces reliable signals and patterns | Smaller position sizes needed to control risk |

| Allows monitoring of multiple assets at once | Some days may offer no viable trade setups |

| Reduces mental fatigue and stress | Requires patience to wait for quality signals |

For traders who value quality over quantity, the 15-minute chart is a solid choice. If you’re comfortable waiting for the right trade setup and prefer a less intense trading environment, this timeframe provides cleaner price action and more dependable signals than faster charts.

How 15-Minute Charts Affect Trade Execution and Hardware Needs

Beyond its trading advantages, the 15-minute timeframe also stands out for its moderate hardware demands. With only four candles forming per hour, this chart generates far less data than shorter timeframes, significantly reducing the strain on your computer’s CPU, RAM, and internet connection. This makes it an excellent option for traders using basic computer setups or those who prefer not to invest in high-end hardware.

You can comfortably monitor multiple charts and tools without worrying about system lag. The slower pace also alleviates the pressure of quick decision-making, giving you time to execute trades thoughtfully.

However, trading on the 15-minute chart means wider stop losses, which will require adjusting your position sizes to maintain sound risk management. For example, if you’re risking 1% of your account on a trade, the larger distance to your stop loss means you’ll need to reduce your position size compared to strategies on a 1-minute chart. This approach demands adequate capital to ensure trades remain worthwhile while keeping risk under control.

Automated tools like stop-loss and take-profit orders are essential for this timeframe, as trades can sometimes last several hours. Unlike 1-minute trading, the 15-minute chart doesn’t require ultra-fast execution speeds, so a stable internet connection and solid-state drive are more than sufficient for smooth trading.

Side-by-Side Comparison: 1-Minute vs. 5-Minute vs. 15-Minute

Choosing between 1-minute, 5-minute, and 15-minute charts can make a big difference in your trading experience. Each timeframe suits different trading styles, capital needs, and hardware setups. The table below breaks down the major factors to help you decide which chart fits your approach best.

Trade frequency is one of the biggest differences. With a 1-minute chart, you’ll likely find several trading opportunities within just a couple of hours. On the other hand, the 15-minute chart might only yield one or two solid setups in an entire day – or none at all if the session is short. The 5-minute chart strikes a balance, providing enough chances to trade without overwhelming you.

Shorter timeframes capture every price movement, which means they’re noisier and demand more mental focus. Longer timeframes, however, smooth out the noise and highlight clearer trends. As Cory Mitchell, CMT, points out:

"The constant barrage of new candles each minute means our mental focus is highest on a 1-minute chart and lower on longer time frames, where new candles/information are forming less often."

– Cory Mitchell, CMT, TradeThatSwing

Capital requirements also vary based on the chart you choose. The 1-minute chart allows for tight stop losses, meaning you can start with less capital and still manage risk effectively, even with a small account. However, forex traders using 1-minute charts often rely on high leverage – sometimes 10x, 20x, or even 50x – to keep risk below 1% of their account balance. In contrast, the 15-minute chart requires more upfront capital due to wider stop losses but may allow trading with little to no leverage.

Complete Comparison Table

| Factor | 1-Minute | 5-Minute | 15-Minute |

|---|---|---|---|

| Trade Frequency | Highest (multiple per hour) | Moderate (few per session) | Lowest (1–2 per day) |

| Noise Level | Very high (random fluctuations) | Moderate (balanced clarity) | Low (clear trends) |

| Decision Speed | Instant (every 60 seconds) | Steady (every 5 minutes) | Relaxed (every 15 minutes) |

| Mental Focus Required | Constant / Highest | High | Lower / Periodic |

| Stop Loss Size | Smallest | Moderate | Largest |

| Position Size | Largest (tight stops allow) | Moderate | Smallest (wider stops require) |

| Starting Capital Needed | Least (due to tight stops) | Moderate | More (wider stops) |

| Hardware Demands | Highest (constant updates) | Moderate | Lowest |

| Best Trading Style | Scalping, high-frequency | Momentum trading | Trend-following, swing |

| Leverage Typically Used | 10x–50x (forex) | 4x–10x | 4x or less |

| Screen Time Required | Continuous monitoring | Regular check-ins | Periodic reviews |

This table also highlights the hardware requirements for each timeframe. The 1-minute chart demands a high-performance setup due to constant updates, while the 15-minute chart can run efficiently on a more basic system. By understanding these factors, you can align your trading tools and resources with the timeframe that best suits your trading style.

Matching Your Timeframe Choice with Your Trading Computer

The demands of trading on 1-, 5-, and 15-minute charts vary significantly, and your computer setup needs to keep up with the pace you choose. For instance, if you’re trading on a 1-minute chart, a new candle forms every 60 seconds, requiring your system to process data 15 times faster than it would for a 15-minute chart.

For 1-minute traders, CPU speed is critical. Scalpers, who rely on split-second decisions, benefit from systems like the Falcon F-1, which boasts CPU Turbo speeds of up to 6.0GHz and 24 processor cores. This ensures your system can handle the constant influx of data without lag. For 5-minute charts, RAM becomes the priority. A minimum of 64GB of DDR5 RAM is recommended to smoothly run multiple chart windows and indicators simultaneously. For 15-minute chart traders, the focus shifts to screen space. A multi-monitor trading setup is ideal for viewing broader market trends alongside your trading charts. However, these hardware needs become more complex when you analyze multiple timeframes at once.

Traders who use Multi-Timeframe Analysis (MTFA) – monitoring 1-, 5-, and 15-minute charts simultaneously – place heavy demands on both their CPU and RAM. Your system must process and synchronize multiple real-time data streams, which can strain less powerful setups. High-performance systems like the Falcon F-52GT (starting at $2,620) are built for this workload, offering support for up to 12 independent monitors and 128GB of DDR5 RAM, making them a top choice for MTFA.

Hardware performance isn’t just a convenience – it can directly impact your trades. Lagging systems may cause slippage or missed entries, which can be costly. For intraday traders, the Falcon F-37GT (starting at $2,215) provides dependable performance, while the Falcon P-32 (starting at $1,765) is a solid option for those primarily working with 15-minute charts.

If you need mobility without sacrificing power, the Falcon F-30 laptop (starting at $3,850) is a standout choice. It handles multiple programs with ease and supports up to three external monitors, allowing you to maintain your MTFA setup wherever you go. Before committing to a system, it’s smart to test your setup on a demo account to ensure it can handle your chosen timeframes and data load without issues.

Conclusion: Selecting the Right Timeframe for Your Trading Approach

Picking the right candlestick timeframe boils down to your trading style, mental endurance, and the capabilities of your hardware. As Cory Mitchell, CMT and Founder of TradeThatSwing, wisely notes:

"There is no perfect combination or answer. A winning system can be built on any time frame or any combination of time frames".

Your chosen timeframe not only shapes your trading strategy but also impacts the technical setup you’ll need.

For scalpers and high-frequency traders, 1-minute charts are the go-to. These charts allow for quick gains by using tight stops and precise position sizing. However, this fast-paced approach comes with steep requirements: intense focus and high-performance hardware capable of processing a constant stream of data without lag. On the other hand, day traders often lean toward 5-minute to 15-minute charts. These timeframes strike a balance between detail and clarity, filtering out the market noise that can lead to false signals. For beginners, starting with 15-minute charts can provide a more manageable pace, reducing the pressure of making split-second decisions.

Your system’s technical capacity is just as important. Shorter timeframes, like the 1-minute chart, generate data at a much faster rate – 15 times faster than a 15-minute chart. This means they require more from your CPU, RAM, and internet connection. Testing your setup on a demo account is a smart move to ensure your hardware can handle the demands, avoiding slippage or missed entries.

Ultimately, the best timeframe is one that matches your trading personality, fits your schedule, and aligns with your risk tolerance, all while ensuring your hardware can keep up when precision matters most.

FAQs

How do I choose the best candlestick timeframe for day trading?

Choosing the right candlestick timeframe depends on a mix of factors. Start by reflecting on your trading style – if you’re a scalper making rapid trades, 1-minute charts might be your go-to. On the other hand, momentum or swing traders often favor 5-minute or 15-minute charts to capture a broader perspective of market movements.

Think about your risk tolerance and how much time you can realistically spend watching the market. If you’re someone who can dedicate hours to monitoring, shorter timeframes might work. But if you’re juggling other commitments, longer timeframes could be more practical.

Another key consideration is the market’s volatility. Shorter timeframes can give you detailed, fast-paced insights, but they also come with more noise, which might overwhelm your analysis. If you rely on technical analysis, shorter charts can provide quick data points, while longer ones are better for spotting and confirming trends over time.

Lastly, make sure your chosen timeframe works seamlessly with your trading tools and hardware. Smooth execution is crucial, and your setup should be ready to handle the pace of your preferred timeframe.

How does my trading style determine the best candlestick timeframe for day trading?

Your trading style significantly impacts the choice of candlestick timeframes, as each style demands a different level of detail and pace. Take scalpers, for instance – they thrive on capturing small, quick price movements. For them, 1-minute charts are ideal because they provide a granular view of rapid market changes. On the other hand, momentum traders, who focus on trends that last anywhere from a few minutes to an hour, often lean toward 5-minute charts. These charts strike a balance by filtering out some noise while still delivering enough precision for swift decision-making. Meanwhile, swing-oriented day traders, who hold positions for several hours, gravitate toward 15-minute charts. These offer a clearer picture of larger trends without the overwhelming detail of shorter timeframes.

Your personal circumstances also play a big role. Factors like how much time you can devote to market monitoring, your risk tolerance, and whether you rely more on technical or fundamental analysis are key considerations. Shorter timeframes, like 1- to 5-minute charts, demand constant attention and rapid decisions, making them a good fit for traders who can stay focused and manage tighter stop-losses. On the flip side, longer timeframes, such as 15-minute charts or more, provide a more relaxed trading experience. They allow for larger stop-loss buffers and are well-suited for those who combine technical patterns with broader market trends. Aligning your timeframe with your trading style and personal preferences can lead to better decisions and a smoother trading experience.

What kind of computer setup is best for different candlestick timeframes?

For 1-minute candlesticks, speed is everything. To keep up, you’ll need a high-performance setup featuring a modern Intel Core i5, i7, or i9 processor – or an AMD Ryzen 5, 7, or 9. Pair that with at least 16 GB of RAM, a fast SSD for quick data retrieval, and a dedicated graphics card to handle multiple high-resolution monitors. A stable, low-latency wired internet connection is a must, along with a dependable power source to avoid any interruptions.

For 5-minute candlesticks, the demands are a bit more forgiving. A mid-range CPU like an Intel i5 or Ryzen 5, combined with 8–12 GB of RAM, should suffice – especially if you’re not juggling too many extra programs. While the graphics requirements aren’t as intense, a multi-monitor setup is still beneficial for keeping tabs on multiple symbols.

For 15-minute candlesticks, the workload is lighter. A basic setup with an Intel i5 or Ryzen 5, 8 GB of RAM, and integrated graphics should do the job. That said, a solid SSD and a stable wired internet connection are still key for smooth operation.