Day trading options is a fast-paced way to trade financial markets, allowing you to profit from short-term price movements without holding positions overnight. It combines the flexibility of options with the speed of intraday trading, but it also comes with risks and requires proper preparation.

Key Takeaways:

- What it is: Day trading involves buying and selling options contracts within the same trading session to capitalize on quick price changes.

- Why it’s appealing: Options offer leverage, limited risk (premium paid), and flexibility to trade both rising and falling markets.

- Who it’s for: Active U.S. traders with at least $25,000 in account equity (as required by FINRA‘s Pattern Day Trader rule).

- What you’ll need: Knowledge of options terms (e.g., calls, puts, the Greeks), a reliable trading setup, and a written plan for risk management.

- Common strategies: Long calls/puts for price trends, straddles/strangles for volatility, and credit spreads for range-bound markets.

The Bottom Line: To succeed, focus on liquidity, risk management, and disciplined execution. Only 10-15% of day traders achieve consistent profitability, so preparation is critical. Below, we break down strategies, tools, and steps to help you get started confidently.

Required Knowledge and Tools for Day Trading Options

Options Terminology and Key Metrics

Before diving into options trading, it’s crucial to get familiar with the terminology. A call option gives you the right to purchase an underlying asset at a specific strike price, and its value generally rises when the stock price increases. On the other hand, a put option allows you to sell the asset, gaining value as the stock price drops. The option premium is the total price paid for the contract, which is then multiplied by 100 to calculate the actual cost.

Options are categorized based on their moneyness:

- In-the-money (ITM) options have intrinsic value.

- At-the-money (ATM) options are closest to the current stock price.

- Out-of-the-money (OTM) options consist entirely of time value.

Day traders typically close their positions before the expiration date to avoid risks like overnight exposure and the accelerated time decay that occurs as contracts approach expiration.

Understanding the Greeks is also essential for intraday trading. These metrics help you evaluate how different factors influence an option’s price:

- Delta measures how much the option price changes for every $1 move in the underlying stock.

- Theta reflects the daily cost of holding the option, making it critical for traders who exit positions the same day.

- Gamma shows how quickly Delta changes, which can magnify profits or losses.

- Vega measures the option’s sensitivity to volatility changes, which is especially important during market swings or news events.

| Metric | What it Measures | Importance for Day Traders |

|---|---|---|

| Delta | Price Sensitivity | Estimates how much the option’s price moves per $1 stock move |

| Theta | Time Decay | Reveals the daily "cost" of holding the position; vital for same-day exits |

| Vega | Volatility Sensitivity | Indicates risk if market volatility suddenly drops (volatility crush) |

| Gamma | Delta Acceleration | Shows how quickly Delta increases, potentially impacting profits |

Mastering these metrics is a key step in preparing for trading under U.S. regulations.

U.S. Regulations and Account Requirements

In the U.S., executing four or more day trades within five business days in a margin account – and when those trades make up over 6% of your total activity – classifies you as a Pattern Day Trader (PDT). If you’re flagged as a PDT, you’ll need to maintain at least $25,000 in account equity at all times, as required by FINRA rules. This equity can include both cash and eligible securities. Falling below this threshold will result in trading restrictions until you replenish your account.

Brokers also assign options approval levels based on your financial background and trading experience. Most strategies require Level 2 approval, which involves completing a detailed options application. As a pattern day trader, you can access buying power up to four times your maintenance margin excess, offering significant leverage but also increasing potential risks.

"The rules permit a pattern day trader to trade up to four times the maintenance margin excess in the account as of the close of business of the previous day." – FINRA

With these regulations in mind, it’s essential to focus on selecting the right options to match your trading approach.

Selecting Liquid Options for Day Trading

Liquidity plays a major role in day trading options, as it determines how easily you can enter and exit trades without affecting the market price. Look for options with high trading volume, ideally over 100 contracts per day, and narrow bid-ask spreads. A wider spread increases transaction costs and makes it harder to secure profitable trades.

The most liquid options are often tied to major ETFs like SPY (S&P 500) and QQQ (Nasdaq-100), as well as high-volume stocks like NVDA, TSLA, and AAPL. These assets offer tight spreads and steady trading activity throughout the day. Zero days to expiration (0DTE) options on major indexes have become especially popular since 2022, providing high liquidity for same-day trades.

To manage costs and risks effectively:

- Use limit orders instead of market orders to avoid paying more due to the bid-ask spread.

- Check implied volatility (IV) before entering a trade. High IV inflates premiums, while low IV can create cheaper entry opportunities.

A Beginner’s Guide to Day Trading Options (w/ Real Example)

Day Trading Options Strategies That Work

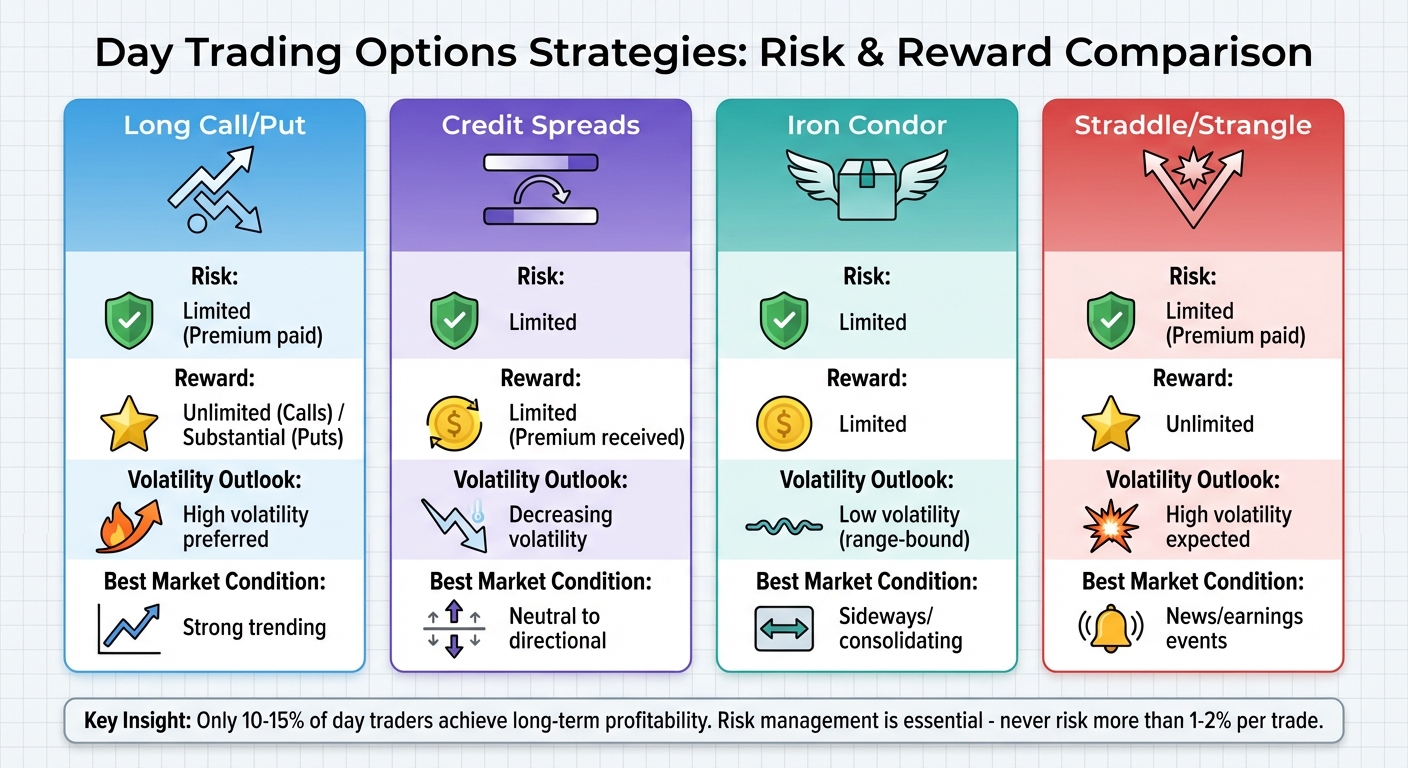

Day Trading Options Strategies Risk Reward Comparison Chart

Trading Direction with Calls and Puts

If you’re looking for straightforward ways to trade price movements during the day, long calls and long puts are great starting points. A long call allows you to profit from bullish momentum, while a long put benefits from bearish moves. These options let you control 100 shares per contract with far less capital upfront, and your maximum loss is limited to the premium you pay. Indicators like RSI or moving averages can help you spot these trends.

Day traders often rely on breakout trading with calls or puts. This involves entering positions when an asset breaks through key support or resistance levels, which can lead to sharp price moves. These volatile moments can quickly increase the value of your options, making them ideal for momentum trading.

Another popular tactic is scalping, which targets small, quick price changes. Tools like MACD and precise timing are essential here. Also, keep an eye on Delta (for price sensitivity) and Theta (for time decay), as they directly impact your trades.

Now, let’s dive into strategies designed to take advantage of volatility and news-driven price swings.

Trading Volatility and News Events

Big news events – like earnings announcements or Federal Reserve decisions – often create significant price swings. Instead of guessing the direction of the move, traders can profit from its magnitude. Two common strategies for this are the straddle and the strangle.

- A straddle involves buying both a call and a put at the same strike price, usually at-the-money.

- A strangle is similar but uses out-of-the-money strikes, making it cheaper but requiring a bigger price move to generate profits.

For example, in February 2024, a trader purchased a $600 straddle on NVDA for $25 ahead of an earnings report when implied volatility (IV) was at 80%. After earnings, NVDA moved $38, resulting in a $13 per contract profit. This worked because the price change exceeded the combined cost of the options. However, timing is everything in these trades. High IV can inflate premiums, and after the event, a "volatility crush" can reduce option values.

For a more conservative approach, consider credit spreads, which limit both risk and reward. Take the example of an iron condor: In March 2023, during a Fed announcement week, a trader sold an SPY 395/400 call spread and a 380/375 put spread for a $2.40 credit. SPY closed at 390, staying within the range, which resulted in the maximum profit. This strategy is especially effective in low-volatility markets with sideways price action.

These strategies highlight the importance of adapting to different market conditions, which brings us to a comparison of risk and reward across various approaches.

Risk and Reward Comparison for Common Strategies

Each strategy has its strengths and is suited to specific market conditions and risk levels. Long calls and puts are great for trending markets with high volatility, offering substantial upside while capping your risk at the premium paid. On the other hand, credit spreads and iron condors aim to generate steady income by collecting premiums, working best in range-bound or low-volatility environments.

| Strategy | Risk | Reward | Volatility Outlook | Best Market Condition |

|---|---|---|---|---|

| Long Call/Put | Limited (Premium paid) | Unlimited (Calls) / Substantial (Puts) | High volatility preferred | Strong trending |

| Credit Spreads | Limited | Limited (Premium received) | Decreasing volatility | Neutral to directional |

| Iron Condor | Limited | Limited | Low volatility (range-bound) | Sideways/consolidating |

| Straddle/Strangle | Limited (Premium paid) | Unlimited | High volatility expected | News/earnings events |

The key to successful day trading is aligning your strategy with current market conditions. Equally important is managing your risk – never risk more than 1% to 2% of your total trading capital on a single trade. Implement strict stop-loss orders to protect against time decay or sudden volatility shifts. It’s worth noting that only 10% to 15% of day traders achieve long-term profitability, so discipline and risk management are essential.

Managing Risk and Trading Psychology

Position Sizing and Capital Allocation

One of the golden rules in day trading options is sticking to the 1% risk rule. Seasoned traders typically limit their risk to no more than 1% of their total account value on any single trade. For instance, if your trading account holds $50,000, your maximum risk per trade should be capped at $500.

To determine how much to trade, use this formula: Account Risk ÷ Stop-Loss Distance = Position Size. Say you’re risking $500 and your stop-loss is $2 away from your entry price; this means you can trade up to 250 shares or 2-3 option contracts, depending on the premium. Aim for a reward-to-risk ratio of at least 1.5x to 3x. So, if you’re risking $500, your profit target should range between $750 and $1,500.

Pattern day traders also have the ability to trade up to four times their maintenance margin excess based on the prior day’s close. However, even with these allowances, staying disciplined and avoiding common traps is essential to long-term success.

Avoiding Common Trading Mistakes

"Day trading is sometimes compared to ‘picking up pennies in front of a steamroller’ due to the risk of one bad trade wiping out a margin position." – Investopedia

Once you’ve nailed down your position sizing, the next step is avoiding costly emotional errors. One of the biggest pitfalls is revenge trading – the urge to quickly recover losses by jumping into impulsive trades without proper analysis. To avoid this, set a daily loss limit before you start trading. If you hit that limit, close all positions and walk away. This simple rule can help you avoid turning a manageable loss into a disastrous one.

Overtrading is another common mistake. Limit the number of trades you take each day to stay sharp and avoid burnout. Remember, options are impacted by time decay (Theta), which accelerates as expiration nears. Taking too many trades not only exposes you to this decay but also racks up commission costs, with fees ranging from $0.50 to $0.70 per contract.

Use hard stop-loss orders instead of relying on mental stops. These ensure your trades exit automatically if the market moves against you. As Cory Mitchell, CMT, explains:

"The occasional trade that gets stopped out and then runs in your expected direction is a small price to pay for controlling risk on ALL trades".

Developing a Written Trading Plan

A solid trading plan goes hand in hand with disciplined risk management. Think of it as your roadmap to consistent decision-making. A written plan helps you stay focused and avoid emotional decisions during volatile market conditions. Clearly outline your strategy, including entry and exit rules, stop-loss levels, profit targets, and how you’ll allocate capital based on technical signals. Writing these rules down before the market opens helps you stick to them when emotions might otherwise take over.

Keep a trading journal to document every trade. Record your reasoning, entry and exit points, and results. Regularly reviewing your journal can reveal patterns – both mistakes to avoid and strategies that work. This reflection helps you refine your approach over time. Plus, accurate record-keeping is crucial for tax purposes, as you can use up to $3,000 of trading losses annually to offset your income tax.

Before trading with real money, spend a few months practicing through paper trading. This allows you to test your strategy and get a feel for market movements without the stress of actual losses. When you’re ready to trade live, start with small positions to build confidence and develop the mental toughness needed to handle larger trades down the line.

sbb-itb-24dd98f

Setting Up Your Day Trading Hardware and Workspace

Hardware Requirements for Fast Trade Execution

When it comes to fast-paced options trading, having the right hardware can make all the difference. A high-performance computer is essential to minimize latency and handle real-time data feeds and complex calculations. For the processor, go with an Intel Core i7/i9 or AMD Ryzen 7/9 with at least 8 cores and a single-thread score of 3,500 or higher.

Memory is another critical component. While 16GB of RAM will suffice for most setups, upgrading to 32GB or more ensures smoother performance, especially when running multiple charts and trading platforms simultaneously. Storage should also be a priority – opt for an NVMe SSD with at least 512GB, though 1TB or more is ideal. These drives significantly reduce boot times, starting your system in about 10 seconds compared to the sluggish 30+ seconds of traditional hard drives.

To handle multiple high-resolution monitors, invest in a dedicated graphics card like the NVIDIA T600 or the RTX series. The T600, for example, supports up to four 5K displays, ensuring seamless performance across your trading workspace.

Redundancy is not just a good idea – it’s essential. Keep a backup computer, have a secondary internet connection (either wired or mobile), and use a UPS that provides at least 30 minutes of power during outages. As one seasoned trader put it:

"Redundancy is not optional. It can be the difference between a profitable day and a costly mistake." – SPX Option Trader

For traders looking for ready-to-go solutions, DayTradingComputers offers systems designed to meet these requirements.

DayTradingComputers Systems for Options Traders

DayTradingComputers provides three purpose-built configurations tailored to options traders:

- Lite System ($3,569): Includes an NVIDIA GeForce RTX 3070 Ti SUPER, 32GB DDR5 RAM, AMD Ryzen 5600X, and a 1TB NVMe SSD. This setup is great for traders running two monitors and standard charting software.

- Pro System ($4,569): Features an RTX 4070 Ti SUPER, 64GB DDR5 RAM, AMD Ryzen 7900X, and a 2TB NVMe SSD. This is ideal for more demanding setups.

- Ultra System ($5,569): Boasts an RTX 4090 SUPER, 128GB DDR5 RAM, AMD Ryzen 9800X3D, and a 4TB NVMe SSD. This is the ultimate choice for traders requiring maximum power.

Each system comes pre-installed with Windows 11 and supports popular trading platforms like NinjaTrader and TradeStation. They also include upgradeable components and advanced cooling solutions, such as the Noctua NH-U12A air cooler, to prevent overheating during intense trading sessions.

Once your hardware is in place, it’s time to focus on connectivity and monitor configuration.

Internet Connection and Multi-Monitor Configuration

A stable and fast internet connection is non-negotiable for day trading. A wired Ethernet connection is the gold standard, offering greater stability and reliability compared to Wi-Fi. Aim for download speeds of at least 20 Mbps, upload speeds of 5 Mbps, and a ping under 15ms to avoid execution delays. Fausto Pugliese, Founder & CEO of Cyber Trading University, emphasizes:

"A wired Ethernet connection is highly recommended over Wi-Fi for trading activities. Ethernet provides a more stable and reliable connection, reducing the risk of disconnections or latency issues." – Fausto Pugliese, Cyber Trading University

For your monitor setup, start with at least two displays to manage charts, options chains, and order entry screens efficiently. Many traders prefer four to six 24-inch monitors for maximum visibility. If desk space is limited, consider a 49-inch super-ultrawide display with a 32:9 aspect ratio or vertical stacking. A resolution of 1080p is the baseline, but 4K monitors provide sharper visuals and allow you to view more data simultaneously. IPS panels are a smart choice for their color accuracy and wide viewing angles.

Finally, invest in ergonomic accessories like an adjustable chair, a sturdy desk, and monitor arms to ensure comfort during long trading sessions. These small tweaks can make a big difference in maintaining focus and reducing strain.

Step-by-Step Guide to Start Trading Options Today

Setting Up Your Brokerage Account and Platform

The first step in trading options is opening a brokerage account with a trusted broker that provides real-time data, options tools, and trading approval for options strategies. During the registration process, you’ll need to provide your personal and financial details.

To trade options, you’ll need to apply for approval. Brokers often use a tiered system for this. Basic tiers allow straightforward trades like buying and selling calls and puts, while higher tiers unlock advanced strategies such as spreads or selling uncovered options. Approval for these levels may require completing a questionnaire or an online course to prove your understanding of options trading.

If you plan to day trade options, selecting a margin account is essential. Keep in mind that under the Pattern Day Trader (PDT) rule, executing four or more day trades within five business days requires maintaining a minimum balance of $25,000. Falling below this amount can limit your ability to day trade until the balance is restored. While some brokers advertise $0 minimums to open an account, active day trading often requires significantly more capital.

Once your account is approved and funded, it’s time to set up your trading platform. Real-time market data is crucial – delayed quotes won’t cut it for capturing fast-moving intraday price changes. Configure your workspace to highlight key metrics known as the Greeks (Delta, Gamma, Theta, Vega), as they are vital for assessing and managing risk. Many brokers now offer commission-free stock trading, but options trades typically come with per-contract fees ranging from $0.50 to $0.65.

With your account ready, the next step is to fine-tune your trading approach.

Testing Your System and Strategies

Start by paper trading to practice without risking real money. Platforms like Webull provide unlimited virtual cash and real-time data, making them ideal for beginners. This allows you to test strategies in live market conditions.

In addition to paper trading, backtesting is a valuable tool. By applying your strategies to historical data, you can gauge how they might have performed in the past. Keep a detailed trading journal where you document your reasoning for entering and exiting trades, as well as the results. During this phase, stick to risking only 1% to 2% of your virtual capital per trade to develop the discipline needed for live trading.

Ensure your hardware and software are optimized for smooth execution. Test your internet connection for stability, and make sure your multi-monitor setup allows you to track all critical data efficiently. Familiarize yourself with your trading platform’s order entry system until it becomes second nature. Configuring technical indicators like moving averages, RSI, MACD, and Bollinger Bands can also help identify potential entry and exit points.

It’s worth noting that only about 10% to 15% of day traders achieve consistent profitability over time, according to studies. If your simulated trades result in consistent losses, take it as a sign to refine your strategies before risking real money.

Once your strategies yield consistent results in a simulation, you’re ready to trade live.

Placing Your First Live Trades

When transitioning to live trading, start small. Your initial focus should be on building confidence and managing the emotions that come with putting real money on the line. Stick to highly liquid options with high trading volume and open interest to ensure you can enter and exit positions quickly, minimizing slippage.

Before placing your first trade, carefully analyze the option chain to choose the right strikes, expiration dates, and Greeks. Use limit orders to avoid wide bid-ask spreads, and set stop-loss orders to limit your losses to 1%–2% of your account. Ensure your trading setup is fully optimized for fast execution, as previously discussed.

Pay close attention to time decay (Theta), which reflects how much an option’s value decreases over a 24-hour period. This effect accelerates as expiration approaches, particularly in the final hours of trading.

Remember, options trades settle under the T+1 rule, meaning they finalize on the next business day. Each standard equity option contract represents 100 shares of the underlying stock, so a $0.55 premium translates to $55 per contract. Keep detailed records of every trade, as intraday trades are typically taxed as short-term capital gains.

In your early weeks of live trading, execution speed is critical. A professional-grade platform and a high-speed internet connection can make all the difference in seizing market opportunities. If you find yourself hesitating or veering off your trading plan, it might be wise to return to paper trading until you regain confidence in your strategy.

Final Thoughts on Day Trading Options

Day trading options demands thorough preparation, unwavering discipline, and reliable technical tools. To navigate this fast-paced world successfully, mastering concepts like the Greeks and implied volatility is critical – otherwise, your capital can dwindle quickly. Research indicates that fewer than 15% of day traders achieve long-term profitability. As we’ve discussed, every element of your trading strategy – from your technical setup to your mental resilience – plays a crucial role in determining your success.

As the saying goes:

"Plan the trade and trade the plan." – Investopedia

Stick to your pre-determined entry and exit points, and limit each trade to just 1%–2% of your capital. Emotional trading is one of the fastest ways to drain your account. Keeping a detailed trading journal can help you identify patterns and refine your strategy. Whether it’s chasing losses with "revenge trading" or ignoring your stop-loss in the hope of a turnaround, impulsive decisions can quickly derail your progress.

Having robust hardware and a fast, reliable internet connection is equally important. In the world of options, where premiums can fluctuate in seconds, even a slight delay can mean the difference between a profit and a loss. Professional-grade systems ensure you’re ready to act without being held back by technical hiccups.

Another key principle: avoid holding overnight positions to protect yourself from gap risks caused by after-hours news. Start small, trade liquid options, and focus on consistent execution over time. True success in day trading isn’t about landing a single big win – it’s about preserving your capital during inevitable losses and steadily building your skills. The strategies, risk management techniques, and technical readiness covered here are all stepping stones to achieving that consistency.

FAQs

What are the main risks of day trading options?

Day trading options carries a variety of risks that traders need to be fully aware of before diving in. One of the biggest concerns is the possibility of quick and significant losses, as option prices can shift dramatically due to market volatility. On top of that, the time decay of short-term options can chip away at their value if the market doesn’t move in your favor swiftly.

There’s also the matter of pattern day trader rules, which require maintaining a minimum account balance of $25,000. If you fail to manage your risks effectively, day trading options could lead to losses that go beyond your initial investment. Approaching this strategy with a well-thought-out plan and only risking money you’re prepared to lose is absolutely crucial.

How can I pick the best options strategy based on market conditions?

Choosing the best options strategy starts with understanding your market outlook and its volatility. If you’re expecting prices to climb, a long call or bull call spread can help you benefit from upward moves. For a smaller rally, a covered call is a great way to earn extra income if you already own the stock. On the flip side, if the market looks bearish, a long put or bear put spread can take advantage of falling prices, while a cash-secured put allows you to collect premiums and potentially purchase shares at a lower price.

For markets that seem neutral or flat, strategies like selling credit spreads or deploying an iron condor can generate profits from limited price movement. On the other hand, if you’re bracing for significant volatility, a long straddle or long strangle can capitalize on large price swings. Additionally, a protective put can shield your existing investments from unexpected drops.

No matter the strategy, always align it with your risk tolerance. A good rule of thumb is to keep your risk on any single trade to 2-3% of your total trading account. By evaluating whether the market is trending up, down, staying flat, or preparing for big moves, you can choose strategies that suit the conditions while keeping your risk under control.

What is the ideal hardware setup for effective day trading?

For a productive day trading setup, focus on having the right tools and a comfortable workspace. Start with two 24- to 32-inch 4K monitors to keep an eye on charts, market feeds, and breaking news. As you get more experience, you can expand to four or more screens for easier multitasking. Using adjustable mounts can help position your monitors for the best view and make upgrades simple.

Comfort is just as important. Choose a sturdy desk and an ergonomic chair to stay comfortable during long trading hours. Equip yourself with a high-precision mouse, a mechanical keyboard, and optional tools like a macro keypad to boost speed and accuracy. Small additions like wrist pads and proper lighting can make a big difference in reducing fatigue. This kind of setup helps you stay focused, make quick decisions, and avoid unnecessary distractions while trading.