Want to learn crypto trading without risking money? Coinbase paper trading gives you a safe way to practice. By simulating real-market conditions with virtual funds, you can test strategies, handle market swings, and build confidence before trading live. Here’s how to get started:

- What is it? A way to trade with virtual funds under real market conditions.

- Why use it? Practice strategies, avoid costly mistakes, and learn to manage risks.

- How to start? Create a Coinbase account, then use third-party platforms like TradingView for paper trading.

- Key benefits: Test strategies, refine skills, and understand market trends without financial risk.

This beginner-friendly approach helps you develop trading discipline and technical skills. Ready to dive in? Let’s break it down.

Setting Up a Coinbase Paper Trading Account

Creating and Setting Up Your Coinbase Account

While Coinbase itself doesn’t support paper trading directly, you’ll first need to create a standard account at coinbase.com. The process is straightforward: sign up, complete identity verification (usually within 24–48 hours), and secure your account with two-factor authentication (2FA). Opt for an authenticator app rather than SMS for added security.

During registration, you’ll provide personal details, create a strong password, and verify your identity by uploading a government-issued ID. Once your account is set up, take time to explore Coinbase’s interface, including its order types and live market data. This familiarity will make the transition to live trading smoother.

After securing your Coinbase account, the next step is to choose a third-party platform that offers paper trading to simulate real-market conditions.

Finding and Activating Paper Trading Features

Since Coinbase doesn’t have built-in paper trading, you’ll need to rely on external platforms like QuantConnect or TradingView. These services allow you to simulate trading under conditions similar to Coinbase. Start by creating an account on your chosen platform and enabling its paper trading mode.

Most platforms offer a demo or simulation mode where you’ll receive a virtual balance to practice trades. You can use this balance to trade popular pairs like BTC/USD or ETH/USD, mirroring the assets you plan to trade on Coinbase.

Once the paper trading mode is activated, you can customize your virtual balance to better reflect real-market scenarios, helping you practice with realistic settings.

Using Virtual USD Balances for Practice Trades

Treat your virtual balance – usually ranging from $10,000 to $100,000 – as if it were real money. This means practicing disciplined risk management and carefully sizing your positions. Displaying prices in familiar dollar terms (e.g., $1,234.56) can help you build a strong understanding of profit and loss dynamics.

To get the most out of your practice sessions, maintain a trade journal. Record your entry and exit points, reasons for each trade, and any lessons learned. While paper trading doesn’t fully replicate the psychological pressures of live trading, it’s an excellent way to sharpen your technical skills and refine your strategies without risking actual money.

Paper Trading on TradingView: Tutorial

Practicing with Live Market Conditions

Once your account is set up, paper trading in live market conditions bridges the gap between simulation and actual trading. This step helps you better understand how trading works in real-time scenarios.

Selecting Trading Pairs and Market Conditions

Start by focusing on major trading pairs like BTC/USD and ETH/USD. These pairs provide high liquidity and moderate volatility, making them ideal for building confidence before venturing into riskier options.

Keep an eye on market activity patterns. Cryptocurrency markets run 24/7, but trading volumes often peak during U.S. business hours and active periods in Asian markets. Practicing during these high-volume times gives you a more realistic feel for spread conditions and order execution speeds.

Market behavior can shift significantly between trending and sideways movements. For instance, momentum-based strategies tend to perform well in trending markets, while range-bound conditions are better suited for mean reversion approaches. Use historical data to practice in various scenarios, including bullish, bearish, and consolidating markets. Once you’ve identified the right pairs and conditions, you can start testing different trading strategies.

Testing Different Trading Strategies

Different strategies suit different trading styles and market conditions. Here are a few to experiment with:

- Day Trading: Focus on short timeframes with quick entries and exits. Test scalping by targeting small price fluctuations in high-liquidity cryptocurrencies.

- Swing Trading: Hold positions for several days and use daily charts to identify key support and resistance levels. This works well in trending markets with clear directional moves.

- Grid Trading: Place multiple buy and sell orders at fixed intervals. For example, set buy orders below the current price and sell orders above it. This method helps remove emotional decision-making.

- Breakout Strategies: Identify consolidation patterns and place orders beyond established support or resistance levels. This allows you to capture momentum from a breakout in either direction.

- Dollar-Cost Averaging (DCA): Make regular, fixed-amount investments regardless of price. Practice this over various market conditions to see how consistent, long-term investing performs.

Setting Up Indicators and Timeframes

Once you’ve chosen a strategy, refine it using technical indicators tailored to your approach.

- Moving Averages: Use a 20-period moving average (short-term) and a 50-period moving average (long-term) to identify trend changes. A crossover where the short-term average rises above the long-term average signals upward momentum.

- Relative Strength Index (RSI): Spot overbought or oversold conditions. For example, go long when the RSI indicates oversold levels, and consider short positions when it signals overbought conditions.

- MACD (Moving Average Convergence Divergence): Use this for momentum signals. Line crossovers and histogram changes can help identify shifts in market sentiment.

- Bollinger Bands: Practice buying at the lower band and selling at the upper band, especially in range-bound markets.

- Volume Indicators: Tools like On-Balance Volume (OBV) confirm price movements. Rising prices with increasing OBV suggest strong buying pressure, while divergences may indicate potential momentum changes.

Timeframes matter too. Use short-term charts for scalping and day trading, while longer-term charts are better for swing trading. To deepen your understanding, test strategies across multiple timeframes. For example, set up different chart layouts to monitor overall trends, pinpoint entry points, and track short-term execution details. This multi-timeframe analysis can give you a clearer picture of the market structure and improve your decision-making process.

sbb-itb-24dd98f

Improving Trading Skills Through Practice

Paper trading is where theory meets action. By treating each simulated trade as if it involved real money, you can develop the discipline and decision-making skills essential for live trading. From managing risk to analyzing every move, this practice lays the foundation for success in the market.

Risk Management and Trade Analysis

Risk management is the cornerstone of trading. Using tools like stop-loss and take-profit orders helps protect your capital while setting clear boundaries between risk and reward. Regularly tracking your performance allows you to gauge the effectiveness of your strategy. As you gain experience, adjust position sizes based on your account balance, but always stick to sound risk management principles.

After each trade, take time to reflect. Did you follow your plan? How did market conditions influence the outcome? Was your timing on point for entries and exits? A quick post-trade review can reveal patterns and help fine-tune your approach over time.

Keeping a Trade Journal and Reviewing History

A trade journal is one of the most powerful tools for improving your skills. Documenting details like the date, time, traded instrument, entry and exit prices, and your reasoning behind each decision provides a clear picture of your trading habits. Don’t forget to note your emotions – this can uncover patterns that might be affecting your judgment.

Regularly reviewing your journal can help you spot recurring mistakes, like overtrading or exiting too early. It also allows you to identify trends in your performance. Compiling reports to compare strategies under different market conditions can show which methods align best with your style. If you’re using platforms like Coinbase, exporting trade history can further refine your analysis by highlighting profitable patterns and areas needing improvement.

Comparing Manual vs. Automated Strategies

Manual and automated trading each come with their own advantages and challenges. Manual trading allows for quick reactions to market events and lets you rely on your intuition, which can be especially valuable during volatile periods. But it requires significant time and emotional energy.

On the other hand, automated trading follows preset rules to execute trades, reducing emotional bias and maintaining consistency. This method works well for strategies that aim for steady, incremental gains over time.

Experiment with both approaches to see what fits your goals and lifestyle. Track your performance metrics and evaluate how much effort each method requires. Whether you choose manual, automated, or a combination of the two, consistent practice through paper trading will help you refine your strategy and build confidence.

Setting Up Your Trading Hardware for Paper Trading

Your hardware setup plays a big role in how well your paper trading experience goes. Just like in live trading, a reliable hardware setup ensures your simulated trades closely mimic real-market conditions. Issues like slow data feeds, system crashes, or display lag can disrupt your learning process during paper trading, just as they would in live trading.

Why Hardware Matters for Trading Performance

Your computer’s processing power directly impacts how quickly market data loads and orders execute. Any delay could throw off your timing and create an experience that’s far from what you’d encounter in live trading.

If you’re tracking multiple cryptocurrency pairs, having multi-monitor support is a game changer. A dual-monitor setup lets you display several charts simultaneously and switch between tools with ease. For instance, you can keep your trade journal open on one screen while monitoring market data on another. Without a capable graphics card, switching between windows can feel clunky and disrupt your workflow.

Sufficient memory (RAM) is critical when running multiple trading applications at the same time. During a typical paper trading session, you might have a browser open for Coinbase, charting software running, performance tracking spreadsheets, and live market news feeds – all competing for your computer’s resources.

Low latency is another key factor. It ensures that the price movements you see on your screen are nearly in sync with real-time market conditions. Even in a simulated environment, working with delayed data can lead to habits that might not serve you well when you transition to live trading. These hardware considerations set the stage for evaluating purpose-built trading systems.

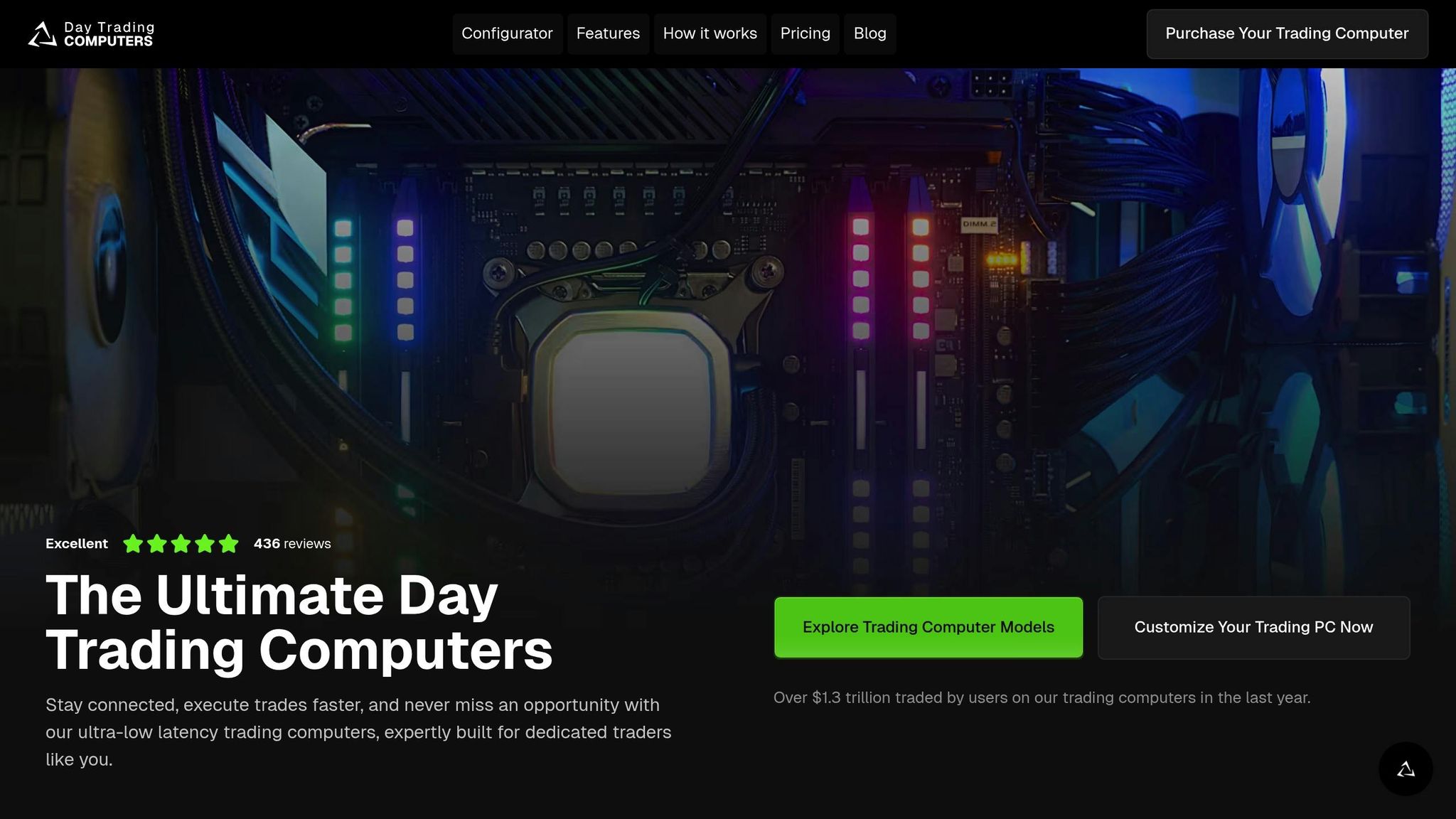

DayTradingComputers Models Comparison

DayTradingComputers offers three hardware configurations designed specifically for trading. Each model caters to different levels of trading activity and multitasking needs.

| Model | Price | Graphics Card | RAM | Processor | Storage | Monitor Support |

|---|---|---|---|---|---|---|

| Lite | $3,569.00 | NVIDIA GeForce RTX 3070 Ti SUPER | 32GB DDR5 | AMD Ryzen 5600X | 1TB NVMe SSD | Up to 2 monitors |

| Pro | $4,569.00 | NVIDIA GeForce RTX 4070 Ti SUPER | 64GB DDR5 | AMD Ryzen 7900X | 2TB NVMe SSD | Up to 2 monitors |

| Ultra | $5,569.00 | NVIDIA GeForce RTX 4090 SUPER | 128GB DDR5 | AMD Ryzen 9800X3D | 4TB NVMe SSD | Up to 2 monitors |

The Lite model is ideal for basic paper trading, such as using Coinbase and running essential applications.

The Pro model is designed for traders who want to run advanced analysis tools alongside their paper trading sessions. Its extra RAM and processing power make it suitable for handling sophisticated charting software and multiple data feeds.

The Ultra model is geared toward serious traders preparing for high-frequency or algorithmic trading strategies, offering top-tier performance for demanding workloads.

Improving Display and Processing Speed

An NVMe SSD significantly reduces application load times and ensures smooth performance when reviewing past trades or working with large datasets for backtesting. Combined with high-resolution displays, it provides a clear view of price patterns and market trends.

A dedicated GPU is essential for rendering charts and indicators without lag. Smooth graphics are especially important for multi-timeframe analysis, where delays can disrupt your focus.

Finally, effective cooling systems prevent thermal throttling, ensuring your hardware maintains consistent performance during long trading sessions. With the right hardware, the skills you develop during paper trading will transition seamlessly to live trading scenarios.

Getting Started with Paper Trading

Paper trading offers a way to experience crypto markets without putting your money on the line. By simulating real market conditions and using advanced trading tools, it provides a safe space for both beginners and seasoned traders to sharpen their skills. The next sections will dive into practical tips for setting up your trading environment and developing effective strategies.

Key Benefits of Paper Trading

One of the biggest advantages of paper trading is the ability to experiment without financial risk. Whether you’re testing swing trading strategies with Bitcoin or trying your hand at scalping Ethereum, this low-pressure environment lets you make mistakes, learn, and refine your methods – all without the stress of losing money.

It also helps you build mental discipline, a crucial skill for any trader. Fear and greed often cloud judgment when real money is at stake, leading to impulsive decisions. Practicing in a simulated setting helps you train your mind to stick to your plan, even when the market gets volatile.

On top of that, paper trading gives you the chance to hone essential trading skills. Repeated practice helps you develop the intuition and precision needed for long-term success.

Building a Reliable Trading Setup

Your trading setup plays a big role in how well you can execute strategies, even in a simulated environment. The habits you form during paper trading should prepare you for real-world trading scenarios.

If you’re unsure where to start, check out our earlier guide on trading hardware for detailed comparisons and tips. Companies like DayTradingComputers offer models designed to handle the demands of serious trading. Whether you go for a basic setup to start practicing or an advanced one for in-depth testing, having the right tools sets the stage for success.

As you progress, consider upgrading to a multi-monitor setup. This allows you to monitor multiple cryptocurrency pairs, analyze live charts, and keep detailed trade records all at once. It creates a professional trading environment that closely resembles live market conditions.

Start Your Paper Trading Journey

Once your hardware is ready and your strategies are in place, it’s time to dive into paper trading. Begin with major pairs like BTC/USD, track your trades carefully, and set weekly goals. This will help you build confidence before moving on to more volatile instruments.

Consistency matters. Establish a daily practice routine and treat it with the same seriousness you would if you were trading with real money. These habits will prove invaluable when you transition to live trading.

Even after going live, experienced traders often return to paper trading to test out new strategies. It’s a great way to stay sharp and adapt to the ever-evolving crypto market.

FAQs

How can I make my Coinbase paper trading experience feel as realistic as possible?

To get the most out of your Coinbase paper trading experience, aim to mirror real trading conditions as closely as possible. Incorporate real-time market data to track accurate price movements, bid-ask spreads, and transaction costs. This approach gives you a clearer picture of how your trades might perform in actual market scenarios.

You should also factor in elements like order execution delays, slippage, and market impact. These details capture the challenges of live trading, helping you fine-tune your strategies and sharpen your decision-making skills – all without risking real money.

What are some common mistakes beginners make with paper trading, and how can I avoid them?

Beginners often stumble in paper trading by not treating it with the seriousness it deserves. Some get carried away by early wins, becoming overconfident, while others neglect proper risk management or fail to track and evaluate their trades. These missteps can stall progress and lead to unrealistic expectations when transitioning to live trading.

The key to avoiding these traps is to approach paper trading as if it were the real deal. Establish clear trading rules, stick to practical strategies, and make it a habit to review your performance regularly. This kind of disciplined practice not only sharpens your decision-making but also lays the groundwork for success when you step into actual trading.

How can I pick the best trading strategy to practice with a Coinbase paper trading account?

When you’re deciding on a trading strategy to try out with a Coinbase paper trading account, the first step is to define your trading goals and understand your risk tolerance. Are you aiming for quick, short-term profits, steady long-term growth, or perhaps a combination of the two? Pinning this down will guide your approach.

Next, explore strategies that align with your interests and trading style. You might look into methods like trend following, range trading, or scalping, and test how they perform under different market conditions. It’s essential to regularly review and evaluate your trades. This helps you identify patterns, fine-tune your strategy, and steer clear of impulsive decisions that could derail your progress.

Another useful tool? Backtesting. By using historical data, you can gauge how effective your strategies might be without risking anything. The secret to success lies in consistent practice and staying flexible. As you gain experience, you’ll naturally refine your skills – all within the safety of a risk-free environment.