In 2025, automated trading bots are a must for traders looking to handle fast-moving markets like stocks, crypto, and forex. The challenge? Picking the right tool. Two popular options – TradersPost and SignalStack – offer distinct features, pricing models, and integrations. Here’s what you need to know:

- TradersPost: Offers unlimited signals and executions for a flat $49/month. It supports stocks, options, futures, and crypto, with integrations for brokers like TradeStation, Alpaca, and Robinhood. Ideal for high-volume traders or those managing multiple strategies.

- SignalStack: Starts at $27/month with a usage-based model (50 signals included; extra signals cost $0.59–$1.49 each). Supports over 33 brokers and a wide range of assets, making it better for low-volume traders or those exploring automation.

Quick takeaway: If you trade frequently, TradersPost’s flat pricing is more cost-effective. For occasional trading, SignalStack might be a better fit.

Quick Comparison:

| Feature | TradersPost | SignalStack |

|---|---|---|

| Pricing | $49/month (unlimited signals) | Starts at $27/month (50 signals) |

| Signal Model | Unlimited | Usage-based |

| Broker Support | ~20 brokers | 33+ brokers |

| Assets | Stocks, options, futures, crypto | Stocks, crypto, forex, CFDs, options |

| Best For | High-volume traders | Low-volume or beginner traders |

Choose based on your trading style and budget.

TradersPost: Features and Pricing

TradersPost is an automation platform designed to connect trading strategies directly to brokerage accounts. With a user base of over 40,000 traders, more than $200 million in connected accounts, and over 20 million trades executed, the platform has proven its capacity to handle large trading volumes across various market conditions. By bridging the gap between strategy creation and execution, it allows traders to focus on refining their strategies and managing risk.

Core Features and Broker Integrations

TradersPost enables automated trading for stocks, options, futures, and cryptocurrencies. It integrates with popular tools like TradingView and TrendSpider, allowing traders to set up strategies that trigger webhooks for automatic trade execution. This webhook-based system is flexible, as it accepts signals from any platform capable of sending HTTP requests.

One standout feature is TradersPost’s standardized Broker API, which streamlines integration with over 20 brokers, including Tradovate, TradeStation, Alpaca, Interactive Brokers, NinjaTrader, E*TRADE, Robinhood, and Coinbase. Since broker capabilities vary, the platform provides a detailed broker connections page outlining supported features like bracket orders, trailing stops, fractional shares, and handling multiple simultaneous orders.

Execution speed is another factor to consider. For instance, Alpaca and Robinhood boast response times under 50 milliseconds, with many requests completing in just 20–30 milliseconds due to their modern API setups. On the other hand, Interactive Brokers averages over 500 milliseconds because its API operates through Trader Workstation (TWS), which can cause delays. To address this, TradersPost employs retry logic and allows up to 10 seconds (including a retry) before timing out. The platform also integrates with tools like TradeZella for trade journaling and supports synchronization with prop firm evaluation accounts through partnerships with Tradovate and ProjectX.

Customer feedback underscores the platform’s reliability and user-friendly design. Jonathan Haggas, a TradersPost user, shared his thoughts:

"Best platform for algorithmic trading. TradersPost takes the struggle out of having to code APIs to each broker and having consolidated subscriptions with extra rulesets based on the subscription preferences makes this top dog from all other platforms used. Easily integrate signals from any webhook such as Python, TradingView, TrendSpider, etc. Customer service is fast and always on the spot although honestly there have really been no issues and has been a very stable and reliable platform. I’d be in a coding zoo mess without this as well as no ability to indirectly share my algos in real time."

With these features in mind, let’s take a closer look at TradersPost’s pricing model and how it supports active traders.

Pricing and Accessibility

TradersPost adopts a flat-rate pricing model that includes unlimited webhook signals and executions. This structure is ideal for traders managing multiple strategies, as it eliminates the per-trade costs often associated with usage-based models. Without worrying about incremental fees, traders can experiment freely with strategy parameters and scale their operations.

Gary, another satisfied customer, shared his experience:

"I am using TradersPost for the purpose of having a webhook connection to place trades with my broker. It has worked exactly like intended since I began. There was a learning process to get the webhook going but only about an hour. With help from the documentation tab, I was trading quickly. So far well worth the money!"

The combination of a predictable monthly fee, extensive broker integrations, and reliable execution makes TradersPost appealing to active traders. New users are encouraged to start with small position sizes and test the platform under different market conditions to ensure it aligns with their trading goals.

SignalStack: Features and Pricing

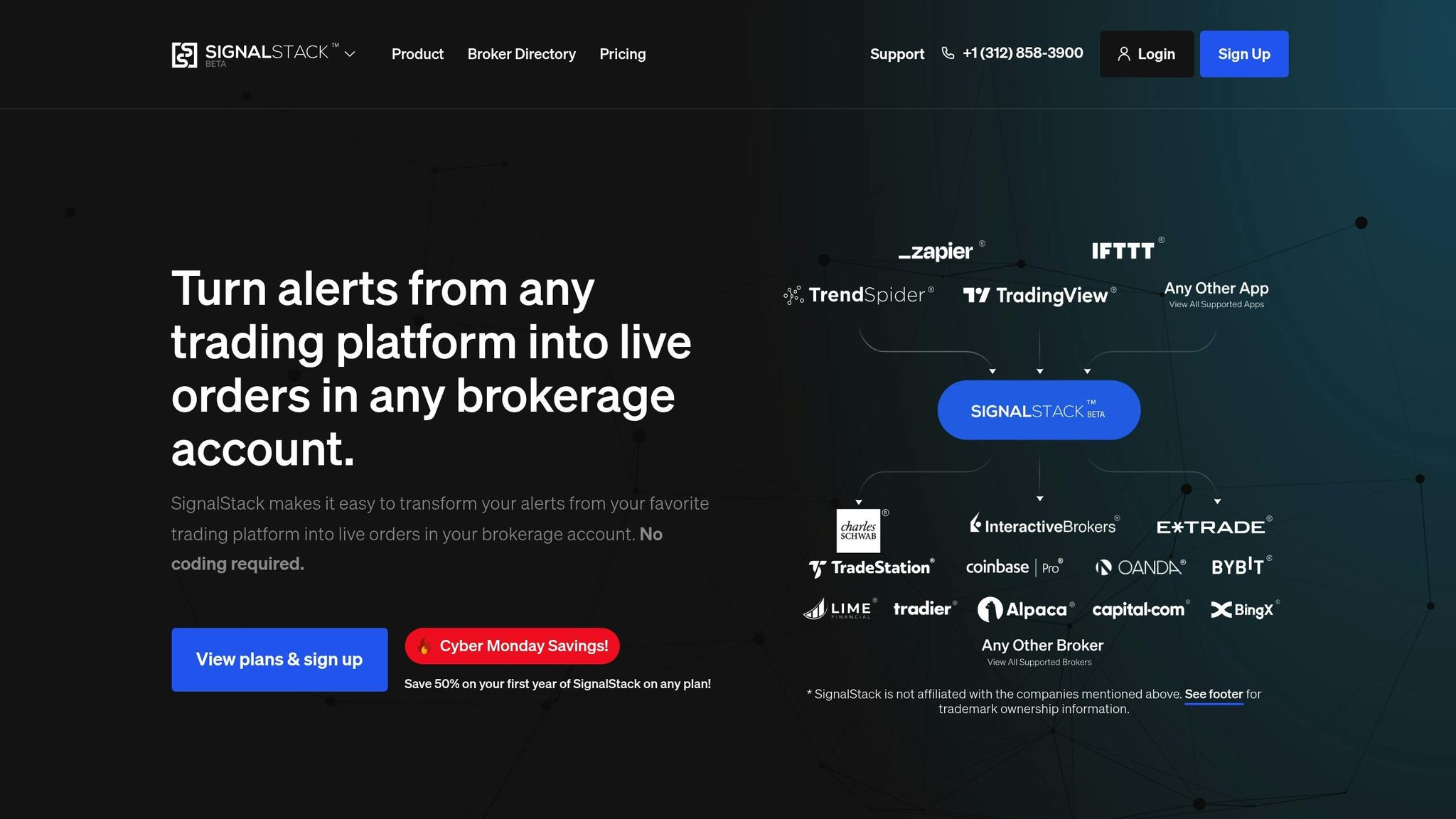

SignalStack is a trading platform designed to route signals directly to brokerage accounts, regardless of the broker. This broker-neutral approach gives traders the freedom to automate their strategies without being tied to a specific broker or trading software.

Key Features and Multi-Broker Integration

SignalStack serves as middleware, taking trading signals from third-party sources and automating order execution. What stands out is its ability to work with multiple brokers at the same time, allowing traders to use their favorite charting tools while managing multiple accounts. However, details about which brokers and asset classes are supported aren’t specified.

The platform focuses on quick execution, although no exact timing metrics are provided.

Pricing Plans and Signal Limits

SignalStack offers tiered monthly pricing based on the number of signals processed. The basic plan has a capped number of signals, while higher tiers provide more generous limits. If users exceed their signal allowance, extra fees apply, meaning the overall cost can rise with increased trading activity.

One notable advantage is that SignalStack allows connections to multiple brokerage accounts without charging additional fees per account. However, all signals – regardless of the account they are routed to – count toward the monthly limit. A trial period is available, giving new users a chance to test the platform’s performance before subscribing.

Up next, we’ll compare SignalStack’s execution speed, pricing, and integration capabilities with TradersPost.

TradersPost vs SignalStack: Side-by-Side Comparison

This comparison breaks down key aspects of TradersPost and SignalStack to help you decide which platform aligns better with your trading needs.

Execution Speed and Reliability

When it comes to automated trading, speed and reliability are critical – especially for strategies like high-frequency trading or scalping, where even milliseconds can make a difference.

SignalStack stands out by providing specific performance benchmarks. It boasts an average order execution time of under 0.45 seconds and a system uptime of 99.99%. These metrics give traders a clear picture of the platform’s reliability. However, some users have reported issues with delays when using Interactive Brokers, particularly when running multiple strategies simultaneously, which could affect complex setups.

TradersPost, on the other hand, emphasizes fast execution and stability but doesn’t share detailed latency or uptime metrics. Its webhook integration is designed for dependable signal transmission, which is essential for time-sensitive strategies. Additionally, TradersPost offers unlimited webhook signals and executions, making it a strong choice for high-volume traders who want to avoid usage limits.

While SignalStack’s speed metrics cater to traders who need every millisecond, TradersPost’s unlimited execution model provides flexibility for those managing large-scale or frequent trades.

Pricing and Cost-Effectiveness

The two platforms take very different approaches to pricing, and your trading volume will play a big role in determining which one fits your budget.

TradersPost uses a flat-rate model priced at $49 per month. This fee covers unlimited webhook signals and executions, regardless of trading activity. For traders with high-volume strategies, this predictable cost structure can be a major advantage. There’s also a 7-day free trial for paper trading, allowing users to test the platform before committing.

SignalStack starts at $27 per month, which seems more affordable initially. However, it operates on a usage-based model, charging per signal processed. The standard plan includes 50 signals per month, with additional signals costing between $0.59 and $1.49 each. This structure might appeal to low-volume traders, but costs can escalate quickly for those sending more than 50 signals monthly. SignalStack does offer some flexibility with 25 free signals to start and a free tier that includes 5 signals per month indefinitely. Another perk is the ability to connect multiple brokerage accounts without extra fees, though all signals count toward the monthly limit.

For traders with frequent or high-volume activity, TradersPost’s flat rate is likely the more economical option. SignalStack, however, may work better for those with occasional trading needs.

Features and Integration Comparison

The platforms differ significantly in their broker support, asset coverage, and advanced trading tools.

SignalStack supports a wide range of brokers – over 33 in total – including Alpaca, Coinbase Pro, Oanda, Tradier, Interactive Brokers, and NinjaTrader. TradersPost, by contrast, focuses on a curated list of brokers like TradeStation, TD Ameritrade, Robinhood, and Coinbase, aiming for optimized execution rather than sheer variety.

In terms of asset coverage, SignalStack handles a broader array, including stocks, crypto, forex, futures, CFDs, and options. TradersPost supports stocks, futures, options, and crypto but doesn’t explicitly include forex or CFDs.

For account management, TradersPost allows one live account and up to four paper accounts, which is helpful for testing strategies. SignalStack allows multiple account connections but has faced criticism for limited multi-account trading capabilities, particularly with Interactive Brokers, which can be a drawback for traders managing complex strategies.

Both platforms integrate with popular charting tools like TradingView and TrendSpider, providing flexibility for technical analysis.

When it comes to advanced features, the platforms cater to different needs. TradersPost offers strategy isolation, which helps prevent the merging issues reported by some SignalStack users. It also includes backtesting previews. SignalStack, on the other hand, provides a Strategy Builder for creating custom alerts, configuring rules, and tracking performance, but it lacks more advanced automation features like smart exits, partial orders, or trailing stops.

Ultimately, the choice between these platforms depends on your priorities. If you value SignalStack’s extensive broker network and asset coverage, it might be the better fit. However, if unlimited executions and strategy isolation are more important to you, TradersPost could be the way to go.

sbb-itb-24dd98f

Which Platform Should You Choose?

The right platform for you depends on your trading style and how much you trade. Here’s a closer look to help you decide.

For High-Frequency and Scalping Traders

If you’re into high-frequency trading or scalping, fast execution is a must. TradersPost offers reliable webhook integration to ensure signals are transmitted quickly and efficiently. During the trial period, it’s a good idea to test the platform’s latency to ensure it meets the demands of your strategy. Also, think about how many signals you’ll need to send.

For Traders Needing Unlimited Signals

For strategies that generate a lot of signals, keeping costs predictable is key. TradersPost offers a flat-rate plan at $49 per month, which includes unlimited webhook signals and executions. This flat pricing can help avoid surprise charges. On the other hand, SignalStack uses a usage-based pricing model with limits, which could lead to higher costs if your signal volume is high. For traders with frequent signals, TradersPost’s unlimited plan might be the more budget-friendly choice.

For Budget-Conscious Traders

How much you trade plays a big role in determining which platform offers the best value. If you trade less frequently, SignalStack’s lower base fee could be a better fit. However, if you’re a high-volume trader, TradersPost’s flat, unlimited pricing might save you money in the long run. Take a close look at your average monthly trading activity to choose the platform that best suits your needs and budget.

Conclusion

TradersPost and SignalStack cater to different trading needs. TradersPost is ideal for high-volume traders who prioritize consistent pricing and reliable performance for fast-paced, high-frequency strategies.

On the other hand, SignalStack is better suited for those with lower trading volumes or traders just starting with automation. Its lower upfront cost makes it an appealing option for exploring automated trading without a significant investment.

FAQs

What are the differences between TradersPost and SignalStack in broker support and asset types?

SignalStack works with more than 33 brokers and exchanges, giving users access to a variety of assets like stocks, cryptocurrencies, forex, futures, and CFDs. On the other hand, TradersPost connects with fewer brokers but focuses on stocks, futures, options, and cryptocurrencies.

For those seeking a platform with extensive broker compatibility and a wider range of assets, SignalStack might be the better fit. However, if your trading revolves around futures, options, or crypto and you’re comfortable with a smaller broker selection, TradersPost could be a solid choice.

How do TradersPost’s flat-rate pricing and SignalStack’s usage-based model compare for different types of traders?

When comparing TradersPost’s flat-rate pricing with SignalStack’s usage-based model, your trading habits play a big role in making the right choice. A flat-rate pricing plan works well for traders who execute a high number of trades, offering a predictable, fixed cost no matter how active you are. Meanwhile, a usage-based model can be more cost-effective for those who trade less frequently, as your expenses adjust based on how much you use the service.

Take a moment to evaluate your trading goals and how often you trade. If you’re a high-frequency trader, the stability of a flat-rate plan might be appealing. But if you trade occasionally, a pay-as-you-go approach could help you keep expenses in check.

How do speed and reliability influence the choice between TradersPost and SignalStack for high-frequency trading?

Speed and reliability play a key role in high-frequency trading. Even the tiniest delays can result in missed trades or higher costs. TradersPost provides a highly efficient platform focused on reducing latency, delivering swift execution and consistent performance.

While both platforms are built to support traders with powerful systems, the best choice depends on your individual trading requirements and setup. Think about how well the platform integrates with your existing tools and whether it can meet the demands of high-speed trading effectively.